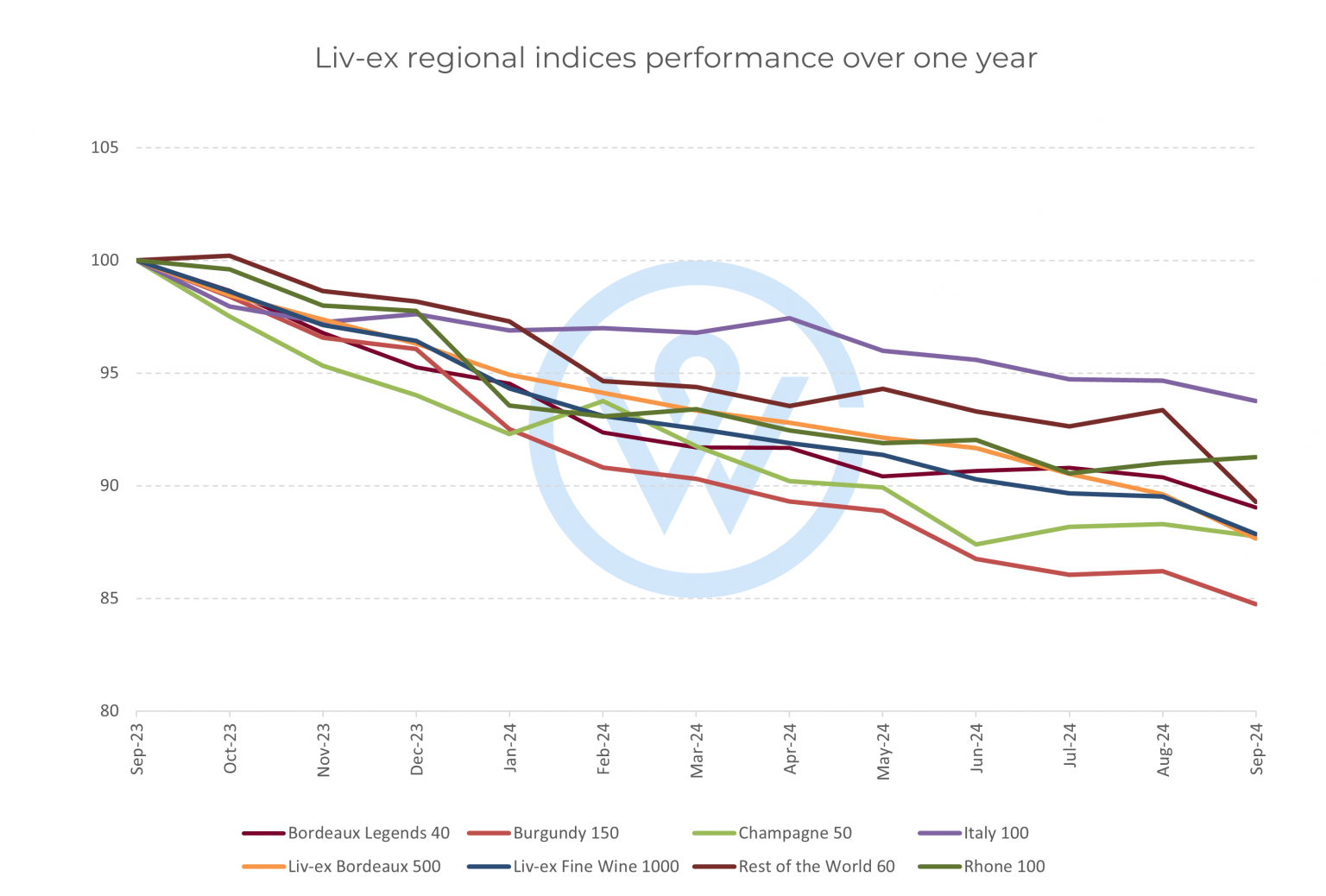

Fine wine prices continued to experience a decline in the third quarter of 2024, with the market seeing an average drop of around 4%, according to WineCap’s latest report.

Bordeaux wines were hit hardest, with a 4.4% fall, while the Champagne region was a notable exception, showing a modest 0.4% increase.

WineCap attributed much of this decline to ongoing market corrections following several years of strong growth, exacerbated by broader economic pressures.

Image credit – WineCap

However, there is optimism for a recovery in the near term, according to WineCap.

The company noted that demand for high-quality wines remains strong, and certain regions, particularly Bordeaux, continue to hold significant market share.

A recovery could be driven by a renewed interest in back vintages, which are showing better value after price corrections.

Looking ahead to the fourth quarter of 2024, WineCap forecasts that the market may begin to stabilise.

Analysts pointed to strong demand for certain top-performing wines, which could drive a rebound in prices.

Some of the top year-to-date performers in the fine wine space include the 2004 Krug Vintage Brut, which is up 21.6%; the 2012 Domaine du Pegau Châteauneuf-du-Pape, which is up 21.2%; and the Sassicaia Tenuta San Guido, which is up 21%.

Among the most expensive fine wines on the market in the third quarter included the Domaine Leroy Romanée-Saint-Vivant at £103,844 and the Domaine d’Auvenay, Mazis-Chambertin at £93,818.

French yields suffer

Although fine wine prices continue to fall, the French wine harvest is predicted to be one of the smallest in recent history due to adverse weather conditions.

According to WineCap: “Burgundy’s output is projected to be down by 25% compared to 2023, while Bordeaux is facing a 10% drop, resulting in the region’s lowest production volume since 2017.

“Historically, such scarcity in Burgundy has driven secondary market price increases, as collectors rush to secure rare wines.

“However, the economic downturn may temper this trend, making selectivity key for investors.

“In Bordeaux, while smaller harvests often support price stability for premium wines, the broader market conditions may limit price recoveries, especially for mid-tier labels.”