2025 Forecast: Sales +1,7%, driven by bubbles. Domestic consumption slows, but Italy remains leader in world production

While the Global wine consumption slows (-3,3% in 2024), theItaly goes against the trend: production up 15,1% and consumption stable (+0,1%). The latest survey by theMediobanca Studies Area, which analyses the balance sheets of the 255 main Italian wine companies (with 2023 revenues of over 20 million euros) for a total of 11,7 billion euros, equal to 94,9% of the national turnover.

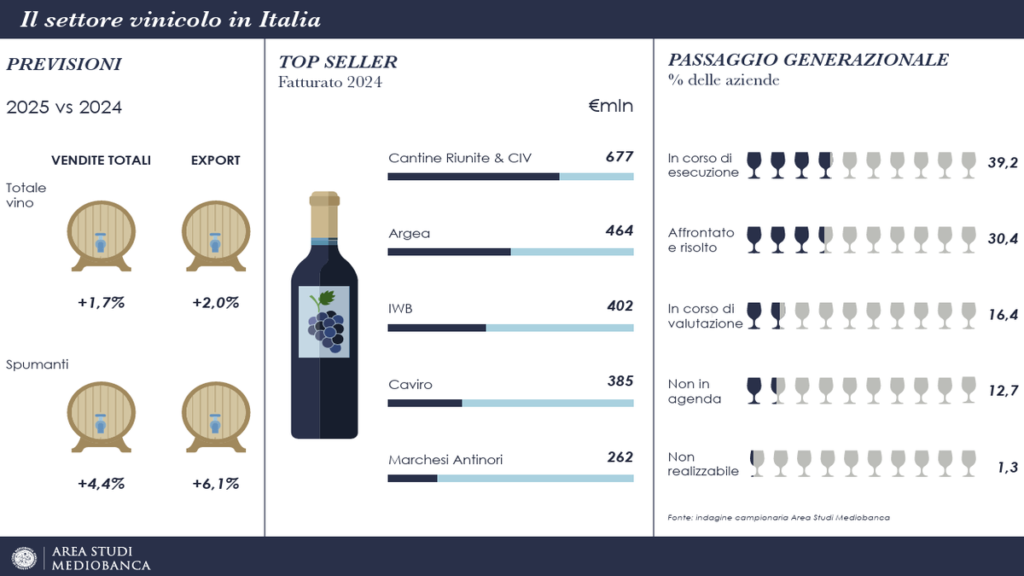

2024 closed with sales almost stable (+0,3%), but the quantities sold fell by 2,5%, with negative performances especially in the out-of-home channel: -4,9% in Ho.Re.Ca. and -8,4% for wine shops and wine bars. On the other hand, theexports supported the sector (+0,7%), driven above all by sparkling wines (+9,1%). For 2025, producers expect a sales growth of 1,7% overall, with the bubbles still protagonists: +4,4% expected revenues, +6,1% exports.

Italy queen of the market, exports grow

THEItaly confirms absolute protagonist in the world panorama of wine. Not only is it the first exporting country by quantity (21,7 million hectoliters in 2024) and second in value (8,1 billion euros, behind France with 11,7 billion), but it is also leader in production, with an increase of 15,1% compared to 2023, compared to a global decline of 4,8%. The trade balance continues to grow, going from 2,6 to 7,5 billion euros in twenty years.

Quasi one bottle out of two is now consumed outside the country of production: the share of wine exported globally has gone from 27% in 2000 to 46,6% in 2024. Italian companies The most export-oriented regions are Fantini Group (96,1%), Ruffino (93,3%), Argea and Pasqua (both over 90%). Veneto, Tuscany and Piedmont are confirmed as the driving regions, with Veneto alone representing more than 35% of national exports.

From bubbles to vegan wines: how the sector map is changing

In 2024 the sector remained substantially stable in terms of turnover (+0,3%), with better performances outside national borders (+0,7%). In tops the rankings for revenue the group is confirmed Cantine Riunite-GIV with 676,6 million euros (+0,6%), followed by Argea (464,2 million, +3,3%) e IWB (401,9 million, -6,3%). Growing companies such as The Brand (+ 11%) and Mack & Schühle (+19,3%). In terms of profitability, H stands outerita Marzotto Wine Estates (EBIT margin 17,8%), Antinori (12%) and Mionetto (9,2%).

Le Exports dominate the balance sheets of many companies: in some cases, such as Fantini Group or Ruffino, the export share exceeds 90%. As for the governance, remains the strong family imprint: 65% of the capital is in the hands of families, which becomes over 80% if cooperatives are included. The generational transition is an open challenge: about 40% of companies are in the transition phase, while another 16% are evaluating how to face it. The stock market remains marginal: only two companies are listed on Euronext Growth Milan (Masi Agricola and IWB).

La sustainability is increasingly present in corporate plans. vegan wines recorded the most marked growth (+31,7%), although with a still small market share (0,9%). The natural wines grow by 4,2%, while organic products are decreasing (-2,6%). 60% of companies have already adopted ESG reports, although only in 16,7% of cases there is a manager entirely dedicated to these issues.

Also growing is thewine tourism (+9% revenues), with three out of four companies opening their cellars to visitors.

Protagonist territories and new routes of Italian wine

Il Veneto confirms itself as the first wine region in terms of production and value, also dominating exports. Puglia, Piedmont and Tuscany follow, which, despite lower volumes, manage to express a high added value. Abruzzo, Lombardy and Friuli-Venezia Giulia also performed well, with the latter growing strongly in 2024 (+8,2% sales, +7,1% exports). These regions, together with Tuscany and the Islands, were the protagonists of the main M&A operations, often linked to business continuity needs or economic difficulties. Even the United States remains a key interlocutor: four acquisition transactions involved Italian companies overseas.

Il future, however, it is played on new challenges: 80% of companies identify in theopening to new markets the key to overcoming the slowdown in domestic consumption, while half of the companies are looking with interest at growth of no/low alcohol lines. Attention to possible obstacles also remains high with 70% fearing a reduction in purchasing power, 60% fearing changes in tastes brought about by new generations, while one company out of two fears the introduction of duties by the United States.

In this complex context, theinvestment in human capital confirms a priority for over half of Italian wine companies, even more than technologies related to automation or artificial intelligence. A signal that the sector, despite difficulties and transformations, intends to remain firmly anchored to its tradition, looking with confidence to global markets.