Jun 11, 2025

IndexBox has just published a new report: GCC – Olive Oil (Virgin) – Market Analysis, Forecast, Size, Trends and Insights.

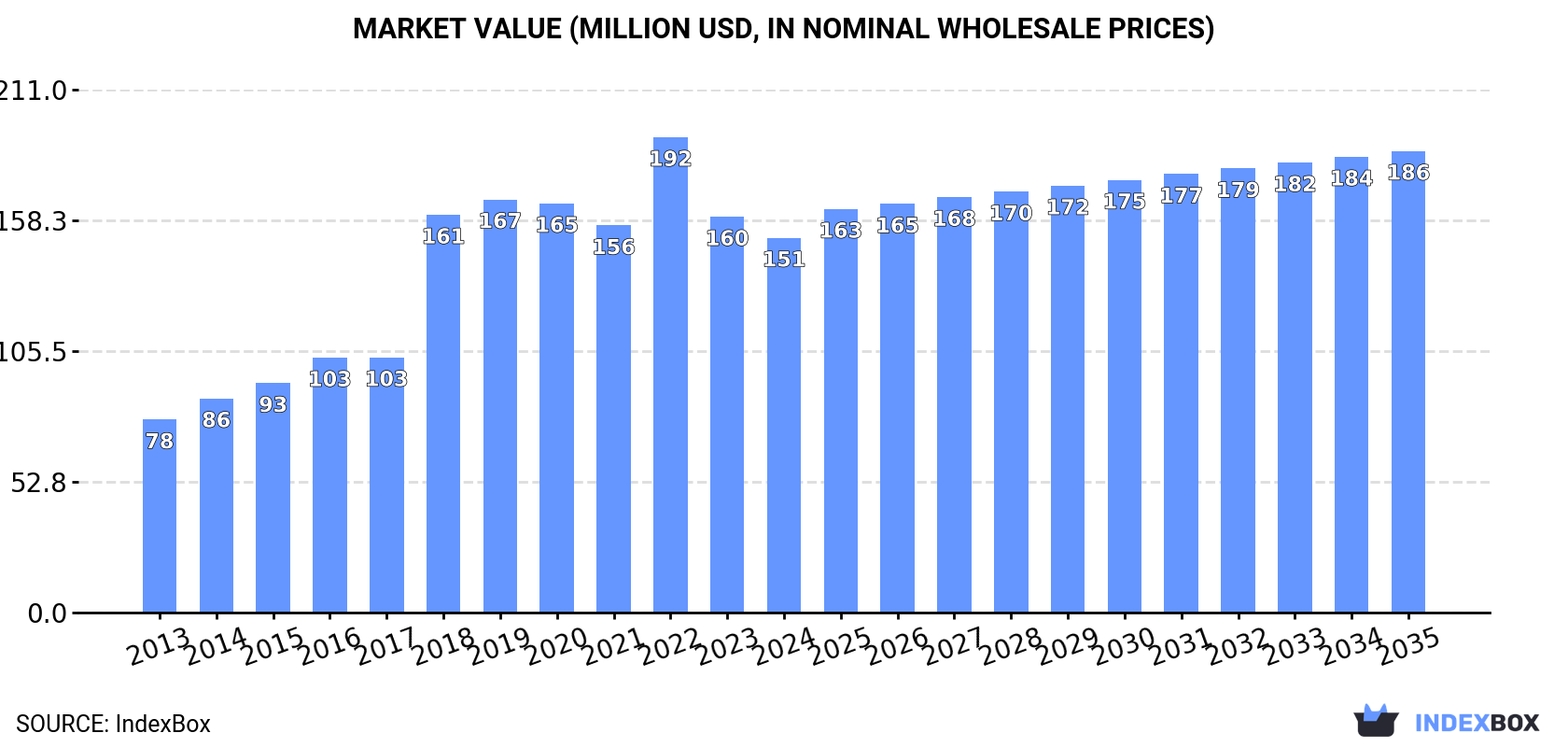

Driven by a growing interest in virgin olive oil, the GCC market is set to see continued growth in the coming years. Despite a deceleration in market performance, both volume and value are expected to increase steadily, reaching 33K tons and $186M respectively by 2035.

Market Forecast

Driven by increasing demand for virgin olive oil in GCC, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +1.2% for the period from 2024 to 2035, which is projected to bring the market volume to 33K tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +1.9% for the period from 2024 to 2035, which is projected to bring the market value to $186M (in nominal wholesale prices) by the end of 2035.

ConsumptionGCC’s Consumption of Virgin Olive Oil

ConsumptionGCC’s Consumption of Virgin Olive Oil

In 2024, virgin olive oil consumption in GCC fell to 29K tons, dropping by -10.7% compared with the previous year’s figure. Over the period under review, consumption, however, posted a temperate increase. Over the period under review, consumption attained the maximum volume at 52K tons in 2022; however, from 2023 to 2024, consumption stood at a somewhat lower figure.

The size of the virgin olive oil market in GCC shrank to $151M in 2024, waning by -5.3% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). Overall, consumption, however, recorded a strong increase. Over the period under review, the market hit record highs at $192M in 2022; however, from 2023 to 2024, consumption failed to regain momentum.

Consumption By Country

The country with the largest volume of virgin olive oil consumption was Saudi Arabia (19K tons), accounting for 66% of total volume. Moreover, virgin olive oil consumption in Saudi Arabia exceeded the figures recorded by the second-largest consumer, the United Arab Emirates (6.9K tons), threefold. The third position in this ranking was taken by Kuwait (1.7K tons), with a 5.9% share.

From 2013 to 2024, the average annual growth rate of volume in Saudi Arabia totaled +2.5%. The remaining consuming countries recorded the following average annual rates of consumption growth: the United Arab Emirates (+5.2% per year) and Kuwait (-1.9% per year).

In value terms, Saudi Arabia ($103M) led the market, alone. The second position in the ranking was taken by the United Arab Emirates ($33M). It was followed by Kuwait.

From 2013 to 2024, the average annual rate of growth in terms of value in Saudi Arabia totaled +7.7%. The remaining consuming countries recorded the following average annual rates of market growth: the United Arab Emirates (+5.4% per year) and Kuwait (+0.7% per year).

The countries with the highest levels of virgin olive oil per capita consumption in 2024 were the United Arab Emirates (670 kg per 1000 persons), Saudi Arabia (519 kg per 1000 persons) and Kuwait (380 kg per 1000 persons).

From 2013 to 2024, the most notable rate of growth in terms of consumption, amongst the main consuming countries, was attained by the United Arab Emirates (with a CAGR of +4.1%), while consumption for the other leaders experienced more modest paces of growth.

ProductionGCC’s Production of Virgin Olive Oil

Virgin olive oil production stood at 3K tons in 2024, remaining relatively unchanged against 2023 figures. Over the period under review, production continues to indicate a relatively flat trend pattern. Over the period under review, production hit record highs in 2024 and is likely to continue growth in years to come.

In value terms, virgin olive oil production skyrocketed to $16M in 2024 estimated in export price. The total production indicated a strong increase from 2021 to 2024: its value increased at an average annual rate of +19.7% over the last three-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, production increased by +71.3% against 2021 indices. The pace of growth appeared the most rapid in 2023 when the production volume increased by 25% against the previous year. Over the period under review, production hit record highs in 2024 and is expected to retain growth in years to come.

Production By Country

Saudi Arabia (3K tons) remains the largest virgin olive oil producing country in GCC, comprising approx. 100% of total volume.

From 2021 to 2024, the average annual rate of growth in terms of volume in Saudi Arabia was relatively modest.

ImportsGCC’s Imports of Virgin Olive Oil

In 2024, imports of virgin olive oil in GCC fell to 29K tons, with a decrease of -6.1% on the previous year’s figure. Over the period under review, imports, however, showed a tangible increase. The growth pace was the most rapid in 2018 with an increase of 49%. Over the period under review, imports attained the peak figure at 55K tons in 2020; however, from 2021 to 2024, imports failed to regain momentum.

In value terms, virgin olive oil imports contracted to $169M in 2024. Overall, imports, however, showed a resilient expansion. The pace of growth was the most pronounced in 2018 when imports increased by 56% against the previous year. Over the period under review, imports reached the maximum at $198M in 2022; however, from 2023 to 2024, imports remained at a lower figure.

Imports By Country

Saudi Arabia was the largest importer of virgin olive oil in GCC, with the volume of imports finishing at 17K tons, which was near 60% of total imports in 2024. The United Arab Emirates (8.9K tons) took a 31% share (based on physical terms) of total imports, which put it in second place, followed by Kuwait (5.9%). The following importers – Bahrain (451 tons) and Qatar (445 tons) – each recorded a 3.1% share of total imports.

From 2013 to 2024, the biggest increases were recorded for Bahrain (with a CAGR of +6.9%), while purchases for the other leaders experienced more modest paces of growth.

In value terms, Saudi Arabia ($108M) constitutes the largest market for imported virgin olive oil in GCC, comprising 64% of total imports. The second position in the ranking was held by the United Arab Emirates ($44M), with a 26% share of total imports. It was followed by Kuwait, with a 5.7% share.

From 2013 to 2024, the average annual rate of growth in terms of value in Saudi Arabia stood at +8.5%. The remaining importing countries recorded the following average annual rates of imports growth: the United Arab Emirates (+7.0% per year) and Kuwait (+1.9% per year).

Import Prices By Country

The import price in GCC stood at $5,806 per ton in 2024, increasing by 4.4% against the previous year. Import price indicated noticeable growth from 2013 to 2024: its price increased at an average annual rate of +4.9% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, virgin olive oil import price increased by +86.7% against 2020 indices. The pace of growth was the most pronounced in 2023 when the import price increased by 49%. The level of import peaked in 2024 and is likely to see steady growth in the immediate term.

Prices varied noticeably by country of destination: amid the top importers, the country with the highest price was Qatar ($7,691 per ton), while the United Arab Emirates ($4,891 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Saudi Arabia (+6.9%), while the other leaders experienced more modest paces of growth.

ExportsGCC’s Exports of Virgin Olive Oil

In 2024, shipments abroad of virgin olive oil was finally on the rise to reach 3.3K tons after two years of decline. Overall, exports showed a buoyant increase. The most prominent rate of growth was recorded in 2014 when exports increased by 181% against the previous year. Over the period under review, the exports reached the maximum at 4.6K tons in 2021; however, from 2022 to 2024, the exports failed to regain momentum.

In value terms, virgin olive oil exports skyrocketed to $17M in 2024. In general, exports continue to indicate significant growth. The pace of growth was the most pronounced in 2014 when exports increased by 250% against the previous year. The level of export peaked in 2024 and is likely to continue growth in the immediate term.

Exports By Country

The United Arab Emirates represented the major exporting country with an export of around 2.1K tons, which reached 61% of total exports. It was distantly followed by Saudi Arabia (1.3K tons), making up a 37% share of total exports.

From 2013 to 2024, the most notable rate of growth in terms of shipments, amongst the key exporting countries, was attained by Saudi Arabia (with a CAGR of +21.3%).

In value terms, the largest virgin olive oil supplying countries in GCC were Saudi Arabia ($8.4M) and the United Arab Emirates ($8.1M).

Among the main exporting countries, Saudi Arabia, with a CAGR of +31.0%, saw the highest growth rate of the value of exports, over the period under review.

Export Prices By Country

The export price in GCC stood at $4,979 per ton in 2024, which is down by -5.3% against the previous year. Export price indicated perceptible growth from 2013 to 2024: its price increased at an average annual rate of +4.9% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, virgin olive oil export price increased by +76.1% against 2021 indices. The most prominent rate of growth was recorded in 2023 an increase of 47% against the previous year. As a result, the export price reached the peak level of $5,257 per ton, and then contracted in the following year.

Prices varied noticeably by country of origin: amid the top suppliers, the country with the highest price was Saudi Arabia ($6,703 per ton), while the United Arab Emirates totaled $3,926 per ton.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Saudi Arabia (+8.1%).

Source: IndexBox Market Intelligence Platform