Does La Place de Bordeaux offer trading opportunities for high-end wines from South America – or is the platform too risky a wager? Arabella Mileham reports.

It is not often that the complex system of négociants and courtiers in Bordeaux is compared to a lager, but like Heineken, in the advert from the 1970s, La Place de Bordeaux seems “to refresh the parts” other trading networks cannot reach. Back in the mists of time, when the great and the good of Bordeaux’s top estates didn’t want to sully themselves with the grubby process of selling, the system of négociants and courtiers developed to spare the estates from this task. But as the

Bordeaux estates started to look beyond the Gironde, it was a South American wine, Almaviva – the result of a collaboration between the Baron Philippe de Rothschild and Concha y Toro families – that kickstarted La Place’s role as a seller of global wine when it launched in 1998. The concept of the ‘hors Bordeaux’ campaign had been born.

Now this campaign sees hundreds of wines from a dozen countries and multiple regions sold into markets around the world, the capillary action of a network of 300 merchants finding corners that other methods just can’t reach. And yet, despite a South American wine helping to spark this revolution, wines from Chile, Argentina and Uruguay make up a small fraction of those on La Place. It begs the question: how has La Place de Bordeaux served South America?

Primarily, being on La Place is about sales – but it’s also about prestige, with the long-established reputation of Bordeaux casting a halo over those sold within the same network.

As Sebastián Zuccardi of Familia Zuccardi told db during last year’s hors Bordeaux release, while getting its wines onto La Place back in 2021 hadn’t been “an obsession”, it had helped the estate to announce its message to a wider audience. “I’m not looking for volume; I’m looking to arrive in areas where we’re not so present,” he said at the time. “People see the wines on La Place and it gets us more prestige.”

Current Market

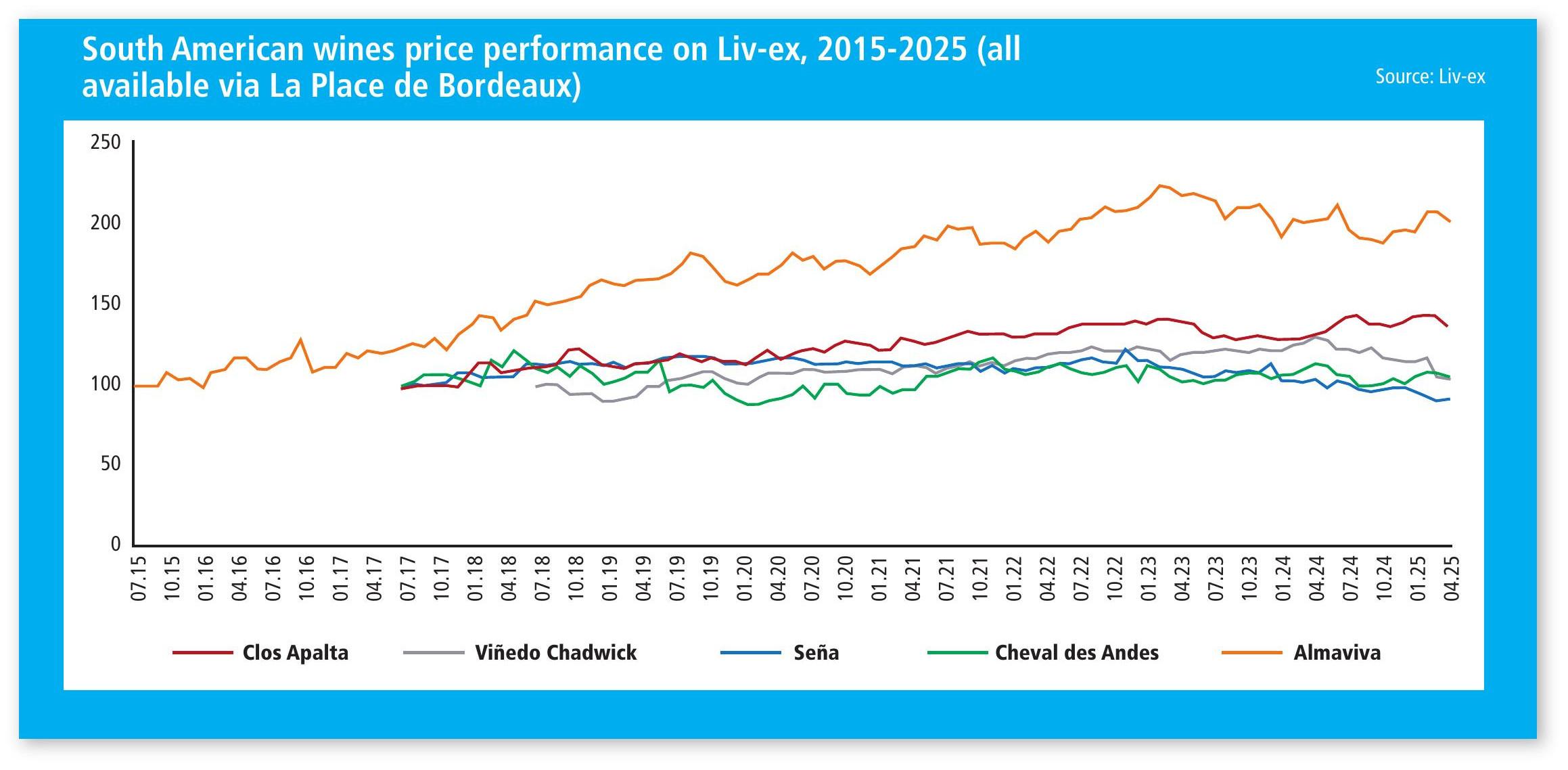

But what happens when the fine wine market hits a downturn? Bordeaux in particular has suffered in recent times, with the Liv-ex Bordeaux 500 index falling 5.6% in the year-to-date and even further down on its October 2022 peak.

The most recent en primeur campaign for the 2024 vintage, which was generally perceived to be lacklustre, clearly did not have a beneficial effect.

As Aurelio Montes Junior of Viña Montes (whose Montes Muse was launched on La Place in October 2022, but is not appearing this year) points out, “everyone is suffering with the négociants today. It’s not a specific situation with what is happening [in Chile], but it is definitely getting complicated”.

Montes argues that, with the price of Bordeaux having dropped so much, there is competition with South America’s more “niche and specific pricing”. This necessitates something of a more aggressive stance on brand building. “We need to move, we need to get out and walk the street to really push the brand again,” Montes says.

Tangible Results

Tangible Results

And it’s not a short term, but a long-term process. “First you need to gain the confidence of courtiers, then négociants, and then the market will arrive. It is a clear way to open doors with tangible results,” Zuccardi argues. “But wine is a long-term activity. Nothing happens immediately, and building a brand is a life’s work.”

And this is key on La Place – if producers think that someone else will build their brand for them, they are in for a shock. “It is a distribution system and it is our work to build our brand, so we have to put our eyes a little bit further as we want to maintain [our position],” Zuccardi explains.

By being on La Place, “you aren’t escaping any of your duties that you do in any of your other roads to market”, Santa Rita head winemaker Sebastián Labbé points out. “It is not a matter that you enter La Place and the problem is solved – it is the beginning of a new problem.” It is a case of being “very supportive”, working with the négociants and their clients to build the brand’s reputation and the customer’s awareness of it, “to get more distribution points and more people getting to know the wine well”, says Labbé, but he stresses that he would “do it exactly the same again”, adding that having his Casa Real wine associated with some of the world’s top bottles was “something that we always dreamed about”. He says: “If there’s a particular place where you get that perception, it’s La Place.”

That being said, the Santa Rita team are aware that “any bad decision that we take now” – be that releasing too much stock, overpricing or undercutting the price – “is going to be with you for the next 10 years”, says Labbé.

Pricing Woes

Generally, pricing for the hors Bordeaux campaign is not quite as sensitive as its larger Bordeaux en primeur counterpart, partly because the numbers are more affordable to begin with.

However, as Liv-ex market analyst Sophia Gilmour warns, there is a downside. “La Place is very helpful for distribution and for building these names, but it really has tied it to Bordeaux,” she warns. “In the late 1990s and early 2000s and through every point where Bordeaux has been highly in demand, these wines have certainly benefitted. But now that Bordeaux is going through a little bit of a slump and having issues with release pricing, these South American wines have not escaped that.”

However, Bordeaux Index investment specialist Geraint Carter argues that the association of South American wines on La Place with Bordeaux is proving “unfortunate”, in that “during most of the time in which they’ve really been pushing themselves on La Place, it has been one of the worst periods of Bordeaux in decades”. Will that look different in five or 10 years’ time? “I don’t know,” he says, arguing that it is work that “will take decades”, involving a slow build-up and a focus on dinners, increasing familiarity with the wines and getting bottles in front of people – adding that it will also require a working secondary market.

What South America does have, though, which marks it out from the top Bordeaux wines that are bought as much for investment as anything else, is a drinking market, says Gilmour, even if the secondary market is more elusive.

“It’s not that they’re not investment wines, but it’s that they lend themselves to drinking more so than their Bordeaux contemporaries,” she explains.

“Part of the reason we don’t have a massive secondary market for them is because they’re being drunk, so they’re maybe doing a little better than some of the Bordeaux guys right now.”

That said, there has been “a slump in engagement with the campaign” this year, Gilmour says, even if it has not been as catastrophic as the lacklustre Bordeaux en primeurs.

Saturation Risk

Over at Berry Bros. & Rudd (BBR), head of buying Martyn Rolph notes that, while South American producers were well established within the September release calendar and have a strong following within BBR’s customer base, there is an element of saturation in the market.

“Increasingly we do see customer fatigue,” he explains. “The sixth major South American release within a short period is not likely to sell as well as the first. From a wine merchant’s viewpoint, it’s also less easy to build innovative, demand-creating activity when we are not purchasing and planning directly with the producer themselves.”

To counter this, there has been “a real effort” by producers to come down in price “in very significant ways”, Gilmour argues. For example, the September releases of Almaviva and Seña were “looking well-priced”, down 33.6% and 35% respectively on last year’s release, although Cheval des Andes was released at a 1% premium on last year’s price (following the previous year’s 17.9% cut).

Producers have also made tweaks to some releases, according to db’s Bordeaux correspondent Colin Hay, who points out that Seña and Viñedo Chadwick are no longer released within the same hors Bordeaux campaign, with Viñedo Chadwick now hitting the market in the March release, and Seña in the autumn. “It is very sensible, because there was a bit of a feeling that people were saying: ‘Which one’s better?’, and particularly Viñedo Chadwick. “They were almost discounting Seña which is a wonderful, wonderful wine,” he explains.

Nonetheless, Hay suggests that some estates may be anxious that things haven’t worked out quite as well as they’d hoped.

This saturation, combined with the poor campaign, suggests that the days of more and more producers coming to La Place are over, Gilmour suggests.

“It seems unlikely to me that La Place will try to expand its offering before fixing internal issues first. So it’s likely we’re going to have a period of consolidation for a while before anything else comes on.”

But within this, there does appear to be a broadening of the styles of wine being released via La Place. Traditionally, the wines tended to be Bordeaux blends or variants thereof but, as Rodrigo Romero, winemaker at Vina Maquis, points out, having a single-vineyard wine with varieties suited to the local terroir, such as Carmenere and Cabernet Franc in Chile, and Malbec in Argentina, gives the wines an attractive USP, meaning less competition with those already traded on La Place.

And this year saw the release of Argentina’s first white wine on La Place, a high-altitude, non-malo Chardonnay from Familia Zuccardi. El Camino de Las Flores 2024, which comes from Monasterio in Tupungato, in the north of the Uco Valley, is the only new release from South America this year.

Even though the market may be suffering now, South America’s producers seem to be philosophical and very much taking a long-term view. As Viña VIK winemaker Priscilla Fernández explains: “The market in general in every part of the industry is slow, but we are not afraid about the market as we are in a move to make innovation our flag, working hard and presenting something new, interesting and well-executed to the market – to be on La Place and show what we are doing.”

South American wines in La Place’s 2025 campaign

Chile

Almaviva

EPU (Almaviva)

Seña

Rocas de Seña

Clos Apalta Prélude

Le Petit Clos

Clos Apalta

VIK

Santa Rita Casa Real

Maquis Viola

Maquis Franco

Viñedos Chadwick

Argentina

Caro

Nicolas Catena Zapata

Adrianna Vineyard Mundus Bacillus Terrae (Catena Zapata)

Cheval des Andes

Finca Canal Uco (Zuccardi)

La Violeta (Bodegas Monteviejo)

Cobos

Uruguay

Related news

Famous winemaking duo behind Domaine de la Côte part ways

Tim Atkin MW curates sixth Ribera del Duero Selections in London

All the drinks in House of Guinness

Dining and Cooking