U.S. Food Colors Market Summary

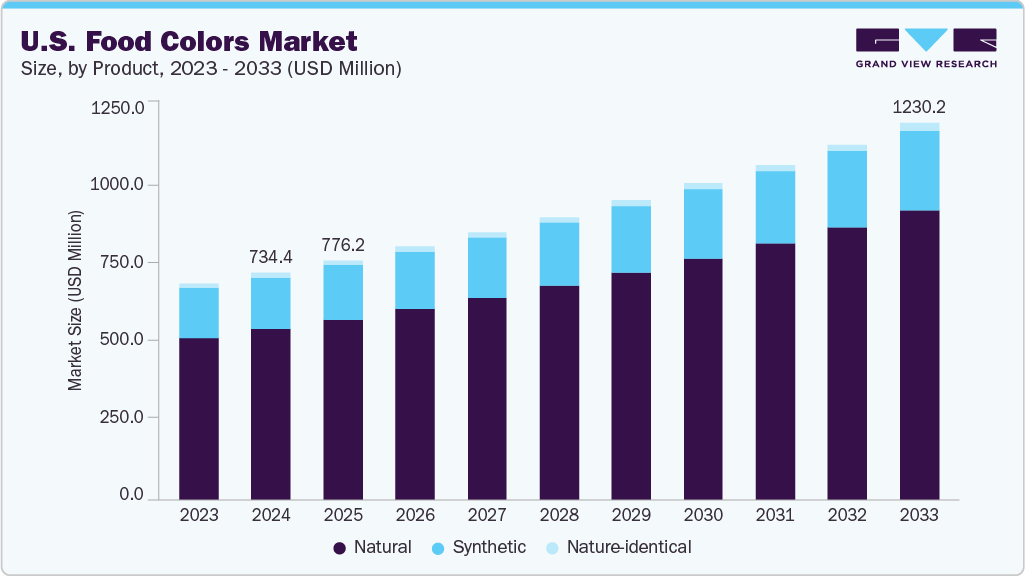

The U.S. food colors market size was estimated at USD 734.4 million in 2024 and is projected to reach USD 1,230.2 million by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The rising consumer preference for natural and clean-label ingredients across food and beverage applications primarily drives market growth.

Key Market Trends & Insights

The U.S. food colors market is projected to grow at a CAGR of 5.9% from 2025 to 2033.

By product, the natural food colors segment is expected to grow at the fastest CAGR of 6.2% from 2025 to 2033 in terms of revenue.

By application, the food segment captured the largest revenue share of 72.5 % in 2024.

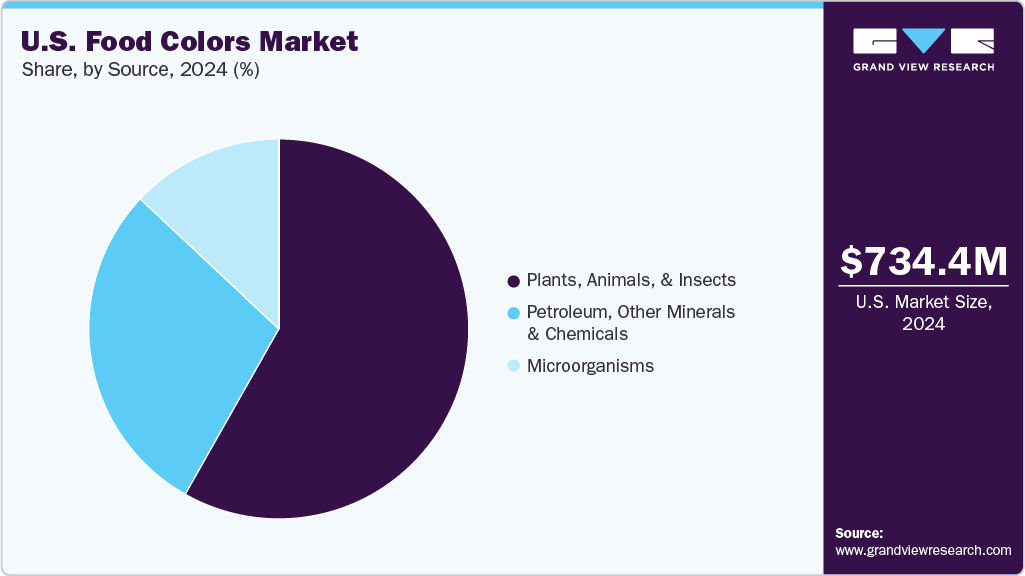

By source, the plants, animals, & insects segment accounted for the largest revenue share of 58.2% in 2024.

Market Size & Forecasts

2024 Market Size: USD 734.4 Million

2033 Projected Market Size: USD 1,230.2 Million

CAGR (2025-2033): 5.9%

Increasing health awareness and regulatory scrutiny surrounding artificial additives have accelerated the shift toward plant- and fruit-derived colorants such as carotenoids, anthocyanins, and spirulina extracts. In addition, strong demand from the processed food, bakery, confectionery, and beverage industries and continuous product innovation by major manufacturers have further strengthened market expansion. Technological advancements in microencapsulation and formulation stability enable greater use of natural colors in heat- and light-sensitive applications, enhancing product performance and consumer acceptance.

Significant opportunities exist in developing sustainable and functional color solutions that align with consumer expectations for transparency, traceability, and nutritional benefits. The growing plant-based and vegan food segments fuel demand for non-synthetic, allergen-free pigments sourced from fruits, vegetables, and microorganisms. Moreover, advancements in biotechnology and fermentation are opening new pathways to produce cost-efficient natural and nature-identical colorants with improved stability and broader color spectra. Collaborations between ingredient manufacturers and food processors for customized color systems-especially in emerging beverage formats and functional foods- present lucrative growth avenues in the medium term.

Despite robust growth prospects, the market faces supply-chain constraints, cost volatility, and regulatory compliance challenges. Natural pigments often exhibit poor heat, pH, and light stability, making formulation and storage complex compared to synthetic counterparts. Sourcing consistency for botanical raw materials is further affected by seasonal variability and sustainability concerns. In addition, the U.S. regulatory framework under the FDA’s 21 CFR Parts 73 and 74 imposes stringent certification and labeling requirements, increasing time-to-market and compliance costs. Balancing color vibrancy, stability, and cost efficiency while maintaining clean-label claims remains a key operational and strategic challenge for manufacturers.

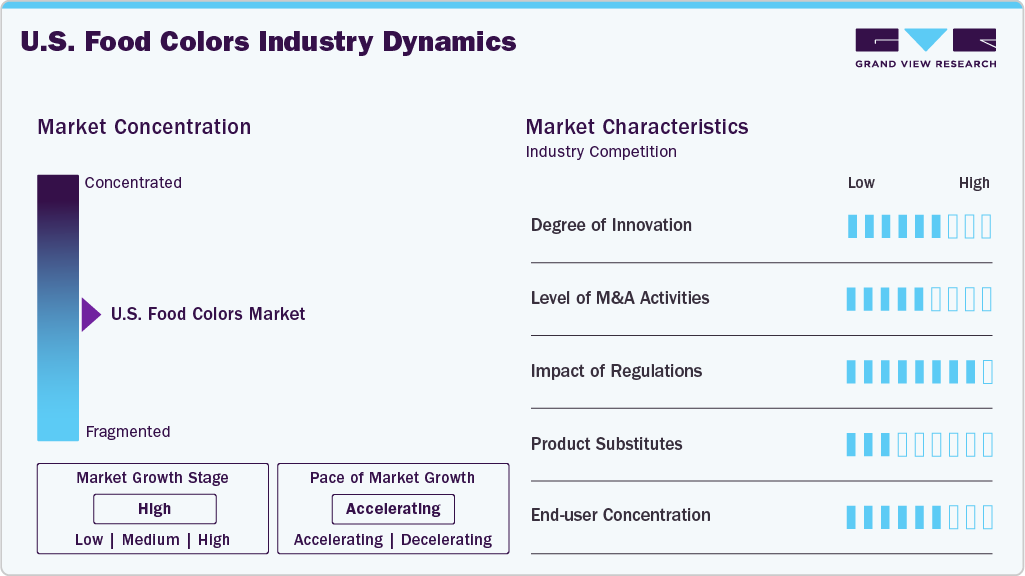

Market Concentration & Characteristics

The U.S. food colors industry is highly competitive, with a mix of multinational ingredient manufacturers and specialized color solution providers. Leading players such as Sensient Technologies Corporation, Oterra A/S, GNT Group, ADM, and Givaudan collectively hold a significant market share, supported by their extensive product portfolios, technological expertise, and strong relationships with major food and beverage brands. These companies actively invest in natural color innovation, focusing on pigment extraction from botanical sources such as fruits, vegetables, and algae to cater to clean-label and plant-based product trends. Continuous advancements in formulation technologies, such as microencapsulation, emulsification, and color stabilization, are key differentiators that enhance performance in challenging food matrices. Strategic mergers, acquisitions, and partnerships are common as players seek to expand their natural color capabilities and regional footprints across North America.

In addition to the global leaders, several mid-tier and niche companies such as ROHA Group, Döhler GmbH, Kalsec Inc., IMBAREX, and Chromatech Incorporated are competing by offering specialized pigment solutions and customized formulations tailored to specific applications in bakery, confectionery, dairy, and beverage segments. These firms increasingly focus on sustainability, traceable sourcing, and regulatory compliance as competitive levers to differentiate themselves in a market driven by consumer transparency. Moreover, competition is intensifying in the synthetic color segment, where players like Sun Chemical and BASF SE continue to innovate around certified dyes and nature-identical pigments to maintain cost and performance advantages. Overall, the market competition is shifting toward innovation-driven differentiation, where clean-label compliance, color stability, and customization capabilities define long-term success and customer retention.

Product Insights

Natural dominated with the largest revenue market share of 75.5% in 2024, primarily driven by the strong consumer shift toward clean-label, plant-based, and minimally processed ingredients. Increasing awareness regarding the potential health risks associated with synthetic dyes, coupled with tightening regulatory controls by the U.S. FDA, has accelerated the replacement of artificial colors with natural alternatives derived from fruits, vegetables, herbs, and microorganisms. Key natural colorants such as carotenoids, anthocyanins, annatto, and spirulina extracts are witnessing heightened demand from bakery, dairy, beverage, and confectionery manufacturers seeking vibrant, stable, and label-friendly pigments. The growth is further supported by advancements in extraction and stabilization technologies that improve pigment solubility, heat and light stability, and application performance, enabling their use in complex formulations like processed foods and carbonated drinks.

Synthetic and nature-identical continue to serve niche and performance-critical applications where high color intensity, cost efficiency, and formulation stability are paramount. Synthetic colors such as FD&C Blue, Red, and Yellow remain preferred in specific confectionery and beverage products due to their superior brightness and resistance to degradation. However, their market share is gradually declining as regulatory pressure and consumer demand favor natural replacements. The nature-identical segment, comprising pigments chemically equivalent to natural ones but produced through controlled synthesis, is gaining traction as a cost-effective alternative combining synthetic dyes’ stability with the perceived safety of natural ingredients. Further sustained innovation in biotechnology, including fermentation-based pigment production, is expected to blur the boundaries between these product categories, offering formulators broader flexibility and improved sustainability across applications.

Application Insights

The food segment dominated the market in 2024, accounting for a substantial revenue share, driven by the widespread use of colorants across processed, bakery, confectionery, dairy, and meat-based products. Manufacturers in the food industry increasingly focus on improving their offerings’ aesthetic appeal and brand differentiation through vibrant and stable color solutions. Within this segment, processed foods such as snacks, soups, sauces, and dressings represent a major demand center, supported by the expanding convenience food culture. The bakery and confectionery categories are among the fastest-growing users of natural pigments such as carotenoids, anthocyanins, and carmine, as these colors enhance product appeal while maintaining clean-label credentials. Similarly, colorants play a key role in flavor association and consumer perception in dairy applications, particularly yogurt, ice cream, and fruit preparations. The growing popularity of premium and artisanal bakery items, health-oriented snacks, and fortified foods further stimulates the adoption of natural and nature-identical colorants to achieve vibrant, stable hues.

The beverages segment also represents a significant and steadily expanding market share, driven by high consumption of juices, functional drinks, carbonated soft drinks, and alcoholic beverages. Beverage formulators prioritize plant-based and pH-stable color solutions that maintain brilliance and consistency under varied storage conditions. The strong shift toward functional and nutraceutical beverages has particularly boosted demand for natural pigments derived from fruits, vegetables, and microalgae that offer dual benefits of coloration and perceived health functionality. Meanwhile, the resurgence of craft and low-alcohol drinks has increased the utilization of natural caramel, anthocyanins, and chlorophyll-based shades to enhance visual appeal. Overall, the growing penetration of natural ingredients across food and beverage categories and ongoing innovation in pigment stabilization and liquid-dispersion technologies reinforce these application areas’ dominance in the market.

Source Insights

The plants, animals, & insects segment accounted for the largest revenue share of 58.2% in 2024, primarily due to the growing consumer preference for naturally derived and sustainably sourced ingredients. Rising health consciousness, combined with the widespread clean-label movement, has accelerated demand for colorants extracted from botanical and animal sources such as carotenoids from carrots and paprika, anthocyanins from berries, chlorophyll from leafy greens, and carmine derived from cochineal insects. Manufacturers are increasingly leveraging these pigments to enhance the visual appeal of products while maintaining natural and allergen-free claims. The segment’s growth is also supported by technological improvements in cold extraction, microencapsulation, and natural stabilization, which have expanded the application scope of these colorants in heat- and light-sensitive formulations like dairy, beverages, and confectionery. The rising emphasis on traceable sourcing and organic certification further strengthens this segment’s dominance, as brands prioritize transparency and sustainability in their ingredient supply chains.

The microorganisms and petroleum, other minerals & chemicals segments collectively form the remaining market share, each serving distinct functional and economic roles. Microorganism-derived pigments, such as spirulina, Monascus, and fungal-based carotenoids, are gaining traction due to their renewable sourcing potential and consistent color yield, addressing challenges associated with the seasonal variability of plant sources. On the other hand, petroleum-based and chemically synthesized pigments continue to be used in specific high-performance applications, particularly in confectionery, beverage, and processed foods, where intense color payoff and long-term stability are essential. However, this segment faces increasing regulatory and consumer scrutiny due to environmental and health concerns, prompting several manufacturers to reformulate toward bio-based or hybrid alternatives. As innovation in biotechnological pigment production accelerates, microorganism-derived sources are expected to emerge as the fastest-growing category, offering a sustainable bridge between natural and synthetic color systems.

Key U.S. Food Colors Company Insights

Some key players operating in the market include Oterra A/S, GNT Group, Sensient Technologies Corporation, San-Ei Gen F.F.I., Inc., Givaudan Sense Colour (Givaudan), ROHA Group, Döhler GmbH, IMBAREX, and ADM.

BASF SE is one of the world’s largest chemical companies, with a diversified portfolio spanning chemicals, materials, nutrition & care, and agricultural solutions. BASF offers a comprehensive range of nature-identical and synthetic color ingredients within the nutrition and care division, primarily carotenoids under its Lucantin and Lucarotin brands, which are widely used across food, beverage, and dietary supplement applications. The company’s expertise lies in developing high-purity, stable, and dispersible formulations that deliver consistent color performance while meeting stringent safety and regulatory standards. BASF’s advanced formulation technologies enable superior solubility and color uniformity in liquid and powdered applications. The company leverages its strong distribution network and technical service capabilities in the U.S. market to serve major food and beverage manufacturers seeking reliable, scalable color solutions. Furthermore, BASF continues to focus on sustainability, process efficiency, and bio-based innovations to enhance its product offerings and align with the growing industry shift toward natural and nature-identical alternatives.

Key U.S. Food Colors Companies:

Oterra A/S

GNT Group

Sensient Technologies Corporation

San-Ei Gen F.F.I., Inc.

Givaudan Sense Colour (Givaudan)

ROHA Group

Döhler GmbH

IMBAREX

ADM

Sun Chemical

BASF SE

International Flavors & Fragrances Inc.

dsm-firmenich

Kalsec Inc.

Chromatech Incorporated

U.S. Food Colors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 776.2 million

Revenue forecast in 2033

USD 1,230.2 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 – 2023

Forecast period

2025 – 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application

Key companies profiled

Oterra A/S; GNT Group; Sensient Technologies Corporation; San-Ei Gen F.F.I., Inc.; Givaudan Sense Colour (Givaudan); ROHA Group; Döhler GmbH; IMBAREX; ADM; Sun Chemical; BASF SE; International Flavors & Fragrances Inc.; dsm-firmenich; Kalsec Inc.; Chromatech Incorporated

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Food Colors Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. food colors market report based on product, source, and application:

Product Outlook (Revenue, USD Billion, 2018 – 2033)

Natural

Carmine

Anthocyanins

Caramel

Annatto

Carotenoids

Chlorophyll

Spirulina

Other Natural Colors

Synthetic

Blue

Red

Yellow

Green

Orange

Violet

Other Synthetic Colors

Nature-identical

Source Outlook (Revenue, USD Billion, 2018 – 2033)

Plants, Animals, & Insects

Microorganisms

Petroleum, Other Minerals & Chemicals

Application Outlook (Revenue, USD Billion, 2018 – 2033)

Food

Beverages

Juices

Functional Drinks

Carbonated Soft Drinks

Alcoholic Beverages

Dining and Cooking