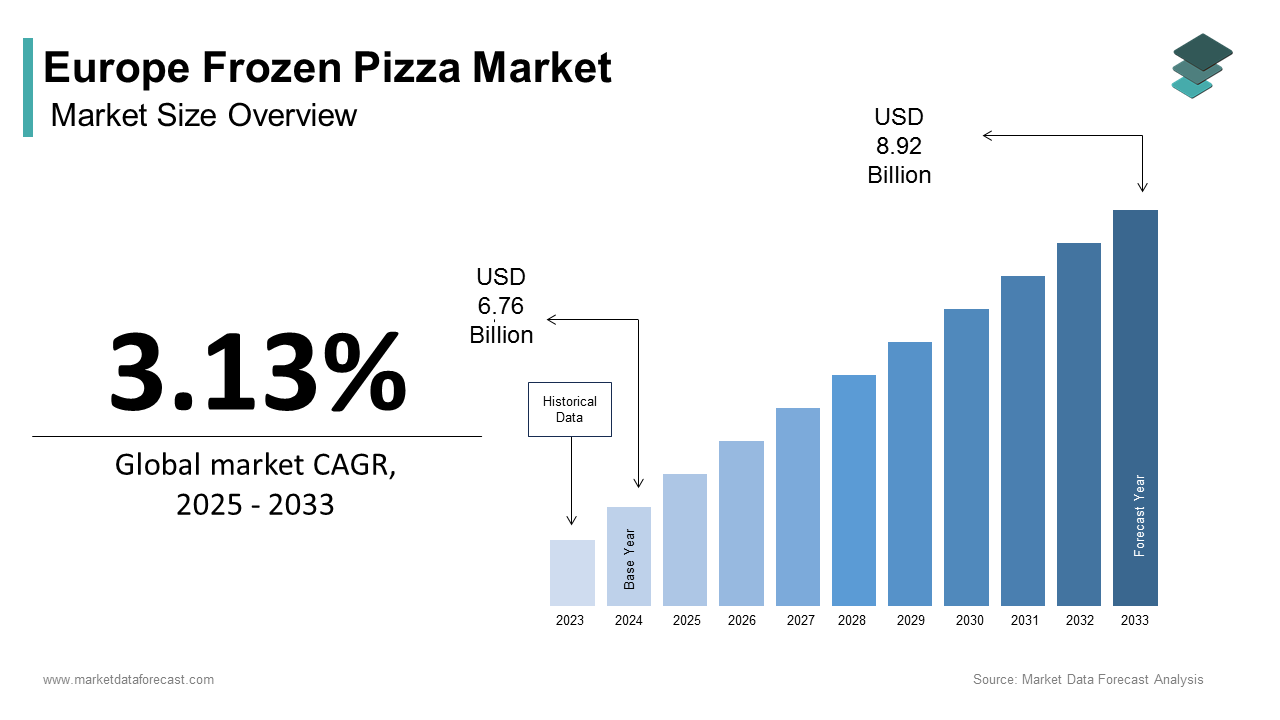

Europe Frozen Pizza Market Size

The Europe Frozen Pizza Market size was calculated to be USD 6.76 billion in 2024 and is anticipated to be worth USD 8.92 billion by 2033, from USD 6.97 billion in 2025, growing at a CAGR of 3.13% during the forecast period.

Frozen pizza is a pre-prepared pizza that has been cooked partially or fully, then rapidly frozen to preserve freshness and extend shelf life. The expansion is fueled by increasing demand for premium and artisanal frozen pizzas, particularly among millennials and working professionals. Italy leads the regional market, accounting for a portion of Europe’s total frozen pizza consumption, as per the Italian Food Federation. A key factor shaping the market is the growing emphasis on product innovation and diverse flavor profiles. As per Eurostat, a share of European consumers prioritize unique toppings and authentic recipes, encouraging brands to experiment with regional and exotic ingredients. Apart from these, the rise of e-commerce platforms has broadened accessibility, which ensures sustained demand across demographics.

MARKET DRIVERS Rising Demand for Convenience Foods

The exponential increase in demand for convenience foods is among the key drivers propelling the growth of the Europe frozen pizza market. According to sources, a portion of European households now rely on frozen meals for quick and hassle-free dining options, creating a lucrative niche for frozen pizza manufacturers. For instance, in France, frozen pizza sales accounted for a key share of all convenience food purchases, as per studies. This trend is further amplified by the growing affordability and accessibility of frozen pizzas compared to dine-out alternatives. Apart from these, advancements in freezing technology have addressed previous concerns about texture and freshness, enhancing appeal. These developments ensure that convenience remains a cornerstone of the market’s growth trajectory.

Expansion of Premium and Artisanal Offerings

The surging popularity of premium and artisanal frozen pizzas bolsters the expansion of the Europe frozen pizza market, and this fuels demand across affluent demographics. According to a study, the premium frozen pizza segment grew in 2022, with markets like Germany and Spain leading the charge. The emphasis on gourmet ingredients and authentic recipes has further amplified this trend. As per sources, a share of millennials and Gen Z consumers prioritize artisanal blends, creating a niche for innovative solutions. Apart from these, the integration of storytelling and brand heritage has enhanced appeal, which addresses previous concerns about authenticity. These factors emphasize the pivotal role of premiumization in reshaping the frozen pizza market.

MARKET RESTRAINTS Health Concerns Over Processed Foods

The growing skepticism surrounding processed foods due to their perceived health risks hampers the growth of the Europe frozen market. According to research, a portion of consumers associate frozen pizzas with high sodium and preservative content, discouraging purchases. For example, in Sweden, retailers reported a decline in frozen pizza sales in 2022. This perception is exacerbated by the lack of transparency in ingredient sourcing and nutritional information. As per research, only a share of consumers trusts existing health claims without third-party certifications, driving demand for cleaner labels. These challenges not only reduce market turnover but also limit opportunities for innovation, posing a significant hurdle for market expansion.

High Costs of Premium Ingredients

The high cost associated with premium and organic ingredients impacts affordability and market accessibility, thus obstructing the expansion of the Europe frozen pizza market. According to sources, organically sourced dairy and meat ingredients used in frozen foods tend to be priced higher than conventional options because of strict certification and production standards. As per research, many retailers in Switzerland continue to view cost as one of the main challenges in expanding fully organic product lines within their supply chains. Affluent consumers can easily afford sustainable options, but the high costs present a significant financial obstacle for middle-income households, which hinders widespread adoption.

MARKET OPPORTUNITIES Adoption of Plant-Based and Vegan Options

The integration of plant-based and vegan options creates a major opportunity for the growth of the Europe frozen pizza market. According to sources, a growing number of European consumers are open to trying plant-based frozen pizzas, creating new opportunities for brands focusing on dairy-free and meat-free products. As per research, companies in Germany have successfully launched vegan pizza options, recording noticeable sales growth and encouraging broader adoption of plant-based alternatives. A significant driver of this trend is the growing emphasis on sustainability and ethical consumption. According to sources, these products also contribute to lower environmental impacts and improved nutritional value, aligning well with changing consumer expectations. Apart from these, certifications like Vegan Society approval have enhanced brand credibility by attracting eco-conscious buyers. These innovations showcase the immense potential of plant-based pizzas to reshape the market landscape.

Growth of Online Sales Channels

The rapid adoption of online sales channels is another factor that adds to the expansion of the Europe frozen pizza market. This caters to the growing demand for convenience and personalized shopping experiences. According to sources, the online frozen food market across Europe has expanded rapidly, with countries such as the United Kingdom and France emerging as major contributors to this growth. The emphasis on doorstep delivery and subscription services has further amplified this trend. As per research, digital retail platforms have enhanced convenience by enabling faster deliveries and personalized product suggestions, opening opportunities for more innovative market offerings. Besides, advancements in cold-chain logistics have improved usability by addressing previous concerns about freshness. These factors underscore the transformative potential of online sales channels to address emerging consumer needs.

MARKET CHALLENGES Intense Competition and Price Wars

The company is struggling due to the intense competition among established brands and private labels, which complicates efforts to build brand loyalty and thereby hinders the growth of the Europe frozen pizza market. Private label frozen pizzas have become a major part of the European market, with well-known retailers expanding their affordable alternatives to branded products, according to sources. In Italy, supermarket-owned labels have gained strong traction within the frozen pizza segment, appealing to value-conscious consumers, as per research. This competition is further intensified by price wars, making it difficult for brands to differentiate themselves. Customer loyalty in this category often depends on promotional offers and pricing strategies, as many buyers frequently switch between brands, according to sources. Furthermore, the lack of innovation in traditional categories limits opportunities for premiumization, which poses a significant obstacle for market participants striving to stand out.

Fluctuating Raw Material Prices

The volatility of raw material prices continues to be a key challenge for the expansion of the Europe frozen market. The fluctuation impacts production costs and pricing strategies. Cheese prices across Europe have experienced significant fluctuations driven by supply chain disruptions and international trade uncertainties, according to sources. In France, the limited availability of certain cheese types has led to operational challenges for producers and higher manufacturing costs, as per research. These fluctuations create uncertainty for manufacturers, forcing them to either absorb additional costs or pass them on to consumers. Rising inflation across the region has also impacted household purchasing capacity by leading to softer demand for premium dairy products, according to sources. These challenges not only strain profitability but also hinder long-term planning and investment in the market.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

3.13%

Segments Covered

By Size, Distribution Channel, and Region

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Dr. August Oetker Nahrungsmittel KG, Nestlé S.A., McCain Foods Limited, Südzucker AG, General Mills Inc., Wagner, Buitoni, Lidl Stiftung & Co. KG, Conad del Tirreno Soc. Coop. a.r.l.

SEGMENTAL ANALYSIS By Size Insights

In 2024, the regular-sized pizzas segment remained the prominent segment in the Europe frozen pizza market and accounted for 50.6% of the regional market in 2024. Their affordability and widespread appeal, particularly among small households and single consumers, have significantly contributed to the prominence of the regular-sized pizzas segment. For instance, in Spain, regular-sized pizzas accounted for a portion of all frozen pizza sales, as per research. A different factor behind the segment’s dominance is the growing preference for portion-controlled meals. According to studies, regular-sized pizzas reduce food waste while offering optimal value for money, ensuring compliance with consumer expectations. Apart from these, advancements in packaging have addressed previous concerns about storage and reheating, enhancing appeal. These attributes solidify regular-sized pizzas as the cornerstone of the market.

The large-sized pizzas segment is estimated to register the fastest CAGR of 8% from 2025 to 2033. The rapid growth of the large-sized pizzas segment is fueled by their suitability for family gatherings and social occasions, appealing to larger households. For example, in the UK, large-sized pizzas gained immense popularity, with investments surging, as per sources. The growing emphasis on shared dining experiences and value-for-money offerings is also a significant driver of this segment’s rapid expansion. Apart from these, advancements in baking technology have improved usability, addressing previous concerns about consistency. These innovations underscore the transformative potential of large-sized pizzas to address evolving consumer preferences.

By Distribution Channel Insights

The offline sales segment led the Europe frozen pizza market and captured a share of 60.6% in 2024. The dominance of the offline sales segment is driven by its wide availability and accessibility, appealing to mainstream consumers. In Italy, traditional retail outlets continue to dominate the frozen pizza market, reflecting strong consumer preference for in-store purchases, as per research. The growing trend of spontaneous purchases and bulk buying is also a key factor behind the segment’s dominance. Offline shopping channels also provide advantages such as convenience, time efficiency, and competitive pricing that align well with customer expectations, according to sources. Apart from these, the availability of exclusive private-label products has broadened their appeal, enhancing loyalty. These attributes solidify offline sales as the cornerstone of the market.

The online sales segment is anticipated to witness the fastest CAGR of 12.3% during the forecast period, owing to its convenience and personalized shopping experience, appealing to tech-savvy consumers. As per research, Germany has seen strong growth in online frozen pizza sales, supported by rising investments and changing consumer habits. A different accelerator of this rapid expansion of the segment is the growing emphasis on digital accessibility and subscription services. According to sources, e-commerce platforms continue to improve delivery efficiency and provide customized product options, fostering opportunities for innovative business models. Apart from these, advancements in logistics have improved reliability, which solves previous concerns about shipping delays. These innovations showcase the transformative potential of online sales to address evolving consumer preferences.

REGIONAL ANALYSIS Italy Frozen Pizza Market Analysis

Italy dominated the Europe frozen pizza market by commanding a market share of 25.4% in 2024. The country’s deep-rooted pizza culture and emphasis on authentic recipes have positioned it as a leader in the region. For instance, iconic brands like Barilla and Mulino Bianco are renowned globally for their high-quality frozen pizzas, catering to both domestic and international markets. A further propellant of Italy’s success is its proactive adoption of advanced freezing technologies and e-commerce strategies. Apart from these, the rise of specialty frozen pizza shops has enabled Italian brands to offer unique and exotic blends, further boosting demand. These initiatives emphasize Italy’s pivotal role in advancing the Europe frozen pizza market.

Germany Frozen Pizza Market Analysis

Germany was the second largest in the Europe frozen pizza market due to a strong emphasis on health and wellness has solidified its position as a key player. For instance, German brands like Dr. Oetker dominate the plant-based and vegan segments by appealing to health-conscious consumers. A significant driver of Germany’s dominance is its focus on sustainability and ethical sourcing. According to sources, a majority of consumers in Germany now prefer environmentally responsible frozen food options, showing greater sensitivity toward sustainability and ethical production. As per research, the use of biodegradable packaging has strengthened brand appeal and motivated younger buyers to choose more sustainable alternatives. These efforts underscore Germany’s prominence in shaping the future of the Europe frozen pizza market.

COMPETITION OVERVIEW

The Europe frozen pizza market is characterized by intense competition, with established brands and emerging startups vying for market share. Key players like Nestlé and Dr. Oetker dominate the premium and plant-based segments, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like GreenPizza are pioneering eco-friendly packaging, challenging incumbents in the sustainability segment. However, regulatory compliance and raw material volatility remain critical challenges for all participants by shaping the market’s evolution.

KEY MARKET PLAYERS

A few of the dominating players in the Europe frozen Pizza Market include

Dr. August Oetker Nahrungsmittel KG Nestlé S.A McCain Foods Limited Südzucker AG General Mills Inc Wagner Buitoni Lidl Stiftung & Co. KG Conad del Tirreno Soc. Coop. a.r.l Top Strategies Used by Key Players

Key players in the Europe frozen pizza market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. Another strategy is product diversification. This move aligns with the company’s goal of addressing emerging consumer preferences. Besides, as per sources, Barilla has invested heavily in digital marketing to enhance customer engagement and brand loyalty. These strategies reflect a commitment to innovation and market dominance.

LEADING PLAYERS IN THE EUROPE FROZEN PIZZA MARKET

The Europe frozen pizza market is led by three key players: Nestlé, Dr. Oetker, and Barilla, each contributing significantly to the global market.

Nestle

Nestlé, headquartered in Switzerland but with a strong European footprint, offers iconic brands like DiGiorno and Jack’s.

Dr. Oetker

Dr. Oetker, based in Germany, specializes in plant-based and artisanal pizzas, with growing demand for brands like Ristorante and Casa di Mama.

Barilla

Meanwhile, Barilla, an Italian firm, is renowned for its authentic recipes, widely adopted by affluent consumers. These players collectively drive innovation and set benchmarks for quality and sustainability in the Europe frozen pizza market.

MARKET SEGMENTATION

This research report on the Europe frozen pizza market is segmented and sub-segmented into the following categories.

By Size

By Distribution Channel

HoReCa Offline Sales Online Sales

By Region

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe

Dining and Cooking