Market Overview

Market Overview

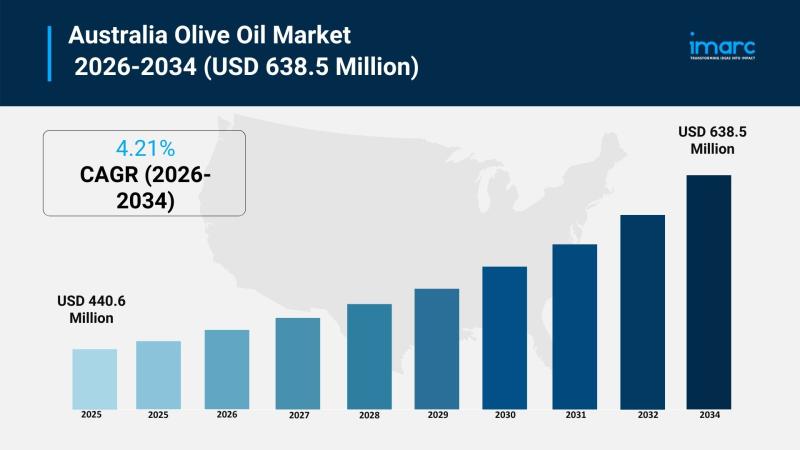

The Australia olive oil market size reached USD 440.6 Million in 2025 and is projected to expand at a CAGR of 4.20 % during 2026-2034, reaching approximately USD 638.5 Million by 2034, supported by growing consumer health awareness, rising demand for premium and organic olive oils, and increasing adoption of Mediterranean-style diets across the country. The market is further strengthened by robust domestic production in key regions such as Victoria, South Australia, and New South Wales, favorable climatic conditions for olive cultivation, and an expanding retail and e-commerce distribution framework.

For more details, see the Australia Olive Oil Market

https://www.imarcgroup.com/australia-olive-oil-market

How AI is Reshaping the Future of Australia Olive Oil Market:

• AI-powered predictive analytics help producers forecast crop yield and quality based on weather and soil data, optimizing farming decisions and harvest timing.

• Smart irrigation and monitoring systems reduce water usage and improve olive tree health using AI-driven sensor networks.

• Automated sorting and quality grading during olive processing enhance consistency and reduce production waste.

• Machine vision systems assist in detecting defects and classifying olives for premium or standard oil production.

• AI-enabled supply chain optimization improves inventory management and distribution efficiency for olive oil brands.

• Demand forecasting algorithms help retailers plan assortments based on consumer preferences for extra virgin, organic, or specialty blends.

Grab a sample PDF of this report:

https://www.imarcgroup.com/australia-olive-oil-market/requestsample

Market Growth Factors

The Australia olive oil market is being propelled by increasing health consciousness among consumers, who are seeking natural and heart-healthy cooking oils. Olive oil, especially extra virgin and organic varieties, is perceived as a healthier alternative to conventional vegetable oils due to its high monounsaturated fat content and antioxidant properties. This trend is complemented by the adoption of Mediterranean-style diets and a focus on clean-label food products in dining and home kitchens.

Another growth factor is the rising demand for premium and artisanal olive oil products, driven by consumers’ desire for quality and traceability. Local producers are expanding their product portfolios to include cold-pressed, certified organic, and region-specific oils, catering to gourmet culinary preferences and lifestyle trends. Enhanced packaging, branding, and product differentiation further fuel consumer interest and loyalty.

In addition, improvements in domestic production capabilities and sustainable farming practices are contributing to market expansion. Favorable climate conditions in major olive-growing regions support high-quality cultivation, while investments in modern processing and distribution infrastructure ensure product availability across retail and e-commerce channels. Expanded consumer education on healthy eating and culinary versatility also bolsters long-term demand for olive oil in both households and foodservice sectors.

Market Segmentation

Product Type Insights:

• Extra Virgin Olive Oil

• Virgin Olive Oil

• Refined Olive Oil

• Olive Pomace Oil

Distribution Channel Insights:

• Supermarkets & Hypermarkets

• Convenience Stores

• Specialty & Gourmet Stores

• Online Retail Channels

Application Insights:

• Culinary Uses (Cooking & Dressings)

• Beauty & Personal Care

• Pharmaceutical & Nutraceutical Applications

• Others

Regional Insights:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Key Players

• Cobram Estate (Australia)

• Boundary Bend Limited

• Red Island Olive Oil

• Olivers & Co

• Mediterranean Foods Australia

• Local Co-operative and Boutique Producers

Recent Development & News

• 2025: Several Australian olive oil brands expanded organic and premium extra virgin lines, responding to rising consumer demand for high-quality, health-focused products.

• Late 2025: E-commerce sales channels witnessed increased olive oil purchases during festive and culinary event seasons, driven by digital marketing campaigns highlighting health and gourmet usage.

• 2025: Retailers and producers collaborated on educational initiatives promoting olive oil benefits in culinary schools, health expos, and farmer markets, boosting category visibility.

If you require additional insights or tailored analysis not covered in this report, we can provide customized research solutions.

https://www.imarcgroup.com/request?type=report&id=32933&flag=F

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services including market assessment, feasibility studies, brand strategy, competitive benchmarking, pricing research, and regulatory approval navigation across diverse industries worldwide.

This release was published on openPR.

Dining and Cooking