US job creation revised sharply lower

Newsflash: Employment growth across America has been much weaker than previously thought over the last three months – a sign that the US labor market may be cooling.

The latest non-farm payroll, just released, shows that US employment rose by just 73,000 in July, rather weaker than the 110,000 new jobs expected.

But the big shock comes in the latest revisions to payrolls, with previous estimates for both May and June being revised sharply lower.

The Bureau of Labor Statistics now estimates that just 19,000 new jobs were created in May, 125,000 fewer than the 144,000 previously estimated.

June’s data has been revised down too – showing that just 14,000 new jobs were created, not the 147,000 reported a month ago.

That means 258,000 fewer jobs were created in May and June than previously thought.

The US unemployment rate has risen to 4.2% from 4.1% in June.

This surprisingly weak data may be a sign that Donald Trump’s trade wars, and the associated uncertainty, have cause more damage to the US economy than previously thought. There could also be an impact from cost-cutting DOGE program pushed by Elon Musk.

The BLS says:

Employment continued to trend up in health care and in social assistance. Federal government continued to lose jobs.

Share

Updated at 08.48 EDT

Key events

Show key events only

Please turn on JavaScript to use this feature

Closing post

Time to wrap up…

Global markets have been rattled by a weak US jobs report which suggests Donald Trump’s trade wars have hurt America’s labor market.

The latest Non-Farm Payroll report showed that the US economy added 73,000 jobs in July, far lower than expected, as the unemployment rate rose to 4.2% from 4.1% in June.

The Bureau of Labor also slashed the number of jobs added in recent months. May’s jobs figure was revised down by 125,000, from 144,000 to 19,000, and June was revised down by 133,000, from 147,000 to 14,000 – a combined 258,000 fewer jobs than previously reported.

Here’s the full story:

The weak jobs report rocked Wall Street, where the Dow Jones industrial average is down 496 points, or 1.1%, at 43,634 points.

US bond yields also fell sharply, as traders raised their bets on cuts to US interest rates this year.

Donald Trump repeated his demand for lower borrowing costs, claiming that Federal Reserve chair Jerome Powell was “a stubborn MORON” for not acting faster.

Stocks have fallen in London, and across Europe.

Investors were already anxious, after Trump announced new tariffs on dozens of US trading partners.

Last night, as the latest deadline to reach deals approached, the US president signed an executive order imposing tariffs ranging from 10% to 41%.

Rates were set at 25% for India, 20% for Taiwan and 30% for South Africa ahead of Trump’s self-imposed deadline of 1 August for striking trade deals with countries worldwide.

Trump also extended the deadline for a tariff agreement with Mexico by another 90 days.

Our US Politics liveblog has full reaction to the jobs report, and the trade war:

Share

There’s been a heavy sell-off across European markets too, amid trade war fears and jitters about the US economy.

Germany’s DAX was down around 2.5% as trading ended, with the situation in Paris even worse – France’s CAC 40 has shed 2.85%.

Italy’s FTSE MIB lost 2.55%.

Share

Updated at 11.48 EDT

FTSE 100’s lowest close in over a week

Tariff anxiety, and the weak US jobs report, have dragged London’s stock market down to its lowest closing level in over a week.

The FTSE 100 index of blue-chip shares has ended the day down 64 points, or -0.7%, at 9,068 points. That takes it away from record highs set yesterday, and is the lowest close since 23 July.

Banks were among those worst hit, pounded by expectations of interest rate cuts, along with some mining companies.

Share

Updated at 11.42 EDT

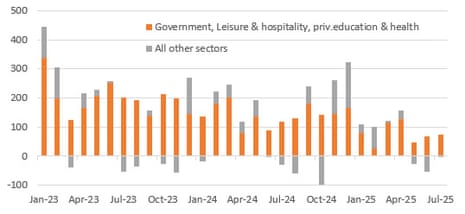

This post from Harvard professor Jason Furman, who chaired Barack Obama’s Council of Economic Advisers, shows how US jobs creation has been weaker this year than in 2023 and 2024:

The jobs slowdown is here with 73K jobs in July & large downward revisions to May & June bringing the average to 35K/month.

Not quite as bad as you might think because steady-state job growth is much lower in a low net immigration world but unemployment still gradually rising. pic.twitter.com/rYSFlI38MR

— Jason Furman (@jasonfurman) August 1, 2025

Share

As well as demanding interest rate cuts (again) today, Donald Trump also called Fed chair Jerome Powell “a stubborn MORON”, and urged top Federal Reserve officials to seize control if Powell fails to cut borrowing costs.

Here’s the full story:

Share

Stephen Miran, who chairs Donald Trump’s Council of Economic Advisors, has conceded that July’s US jobs report “isn’t ideal”.

But Miran also insists that better times are ahead.

Speaking to CNN, Miran suggests that more than half the downward revisions to employment growth in May and June (which cut employment totals by 258,000) were due to “quirks of the seasonal adjustment process”.

He also attributes some of the drop in employment to the fact the White House has “eliminated about a million jobs for foreign born workers”, according to a transcript provided by CNN.

Miran adds:

Finally, we’ve been hearing a lot about uncertainty over the last few months, but that’s all resolved now. We – we’re creating trade deals left and right that have unlocked enormous new potential for the American economy. The tariff uncertainty is fading away. Tariff rates are settling in. The one big, beautiful bill is now law. There’s no more uncertainty over the tax bill either, over the – over potentially the biggest tax hike in American history. And on top of that, there are such strong, powerful incentives in the one big, beautiful bill for investment. Things like full expensing on investment in equipment, in R&D, on new factory structures. These are huge.

So, it’s all going to get much, much better from here.

Share

Updated at 10.45 EDT

A key measure of US job creation is its weakest since early in the Covid-19 pandemic, reports Bloomberg’s Lisa Abramowicz:

ShareUS manufacturers blame tariffs as activity falls

More bad news: economic activity in the US manufacturing sector contracted in July for the fifth month in a row.

The latest poll of purchasing managers at US factories, just released by the Institute of Supply Management (ISM), shows that new orders and backlogs contracted in July, suggesting a weakening in demand.

Prices also rose – perhaps a sign of the impact of tariffs? – while both exports and imports contracted.

This pulled the ISM’s manufacturing PMI down to 48% in July, from 49% in June.

Susan Spence, chair of the ISM’s manufacturing business survey committee:, says:

In July, US manufacturing activity contracted at a faster rate, with declines in the Supplier Deliveries and Employment Indexes contributing as the biggest factors in the 1-percentage point loss of the Manufacturing PMI.

Some companies blamed the disruption and confusion caused by Donald Trump’s trade wars.

One, in the “apparel, leather and allied products” sector, said:

These tariff wars are beginning to wear us out. It’s been very difficult to forecast what we will pay in duties and calculate any cost savings we’ve had this year. Also, tariffs have disrupted our customs import bond.

There is zero clarity about the future, and it’s been a difficult few months trying to figure out where everything is going to land and the impact on our business. So far, tremendous and unexpected costs have been incurred.

A second, in the electrical equipment, appliances and components sector, reported:

Tariffs are causing complete uncertainty around sourcing strategies. A sit-and-wait game for now.

A third company, though, warned that higher interest rates were depressing the construction industry, while a fourth reported strong sales growth driven by datacenter construction.

Share

Updated at 10.47 EDT

A cut to US interest rates in September looks “increasingly likely”, argues James Knightley, ING’s chief international economist.

Knightley says:

It is impossible to deny that the July jobs report is weak with non-farm payrolls rising 73k versus 104k consensus, but the most striking thing is the huge 258k downward revision to the past two months of data. June job gains, which were originally 147k, are now 14k and May’s initially reported gain of 144k is now 19k.

This puts a completely different light on what has been happening in the US economy post the 2 April ‘Liberation Day’ announcements.

Illustration: INGShare

Illustration: INGShare

Updated at 10.15 EDT

Some countries get reprieve in latest Trump tariffs Lisa O’Carroll

Lisa O’Carroll

Lesotho isn’t the only country to receive a reprieve from Donald Trump.

As flagged earlier (see here), Lesotho was facing 50% tariffs on 2 April, an existential threat to its textile industry, but came out on Friday with a 15% rate.

That’s a relief for a state which Trump said “nobody has ever heard of” when he halted USAID earlier this year.

Also getting a drastic reduction in tariffs are Madagascar, down from 47% on 2 April to 15% on 1 August, and Botswana, down from 37% to 15%

Liechtenstein, the wealthy European state best known as a financial centre, has seen rates slashed from 37% to 15%, while the Falkland Islands have gone from 41% to 10%.

Cambodia went from 49% to 19%, while Iraq only got a four-point reduction, from 39% to 35%

Share

Updated at 10.17 EDT

Dining and Cooking