Aug 28, 2025

IndexBox has just published a new report: Northern America – Olive Oil (Virgin) – Market Analysis, Forecast, Size, Trends and Insights.

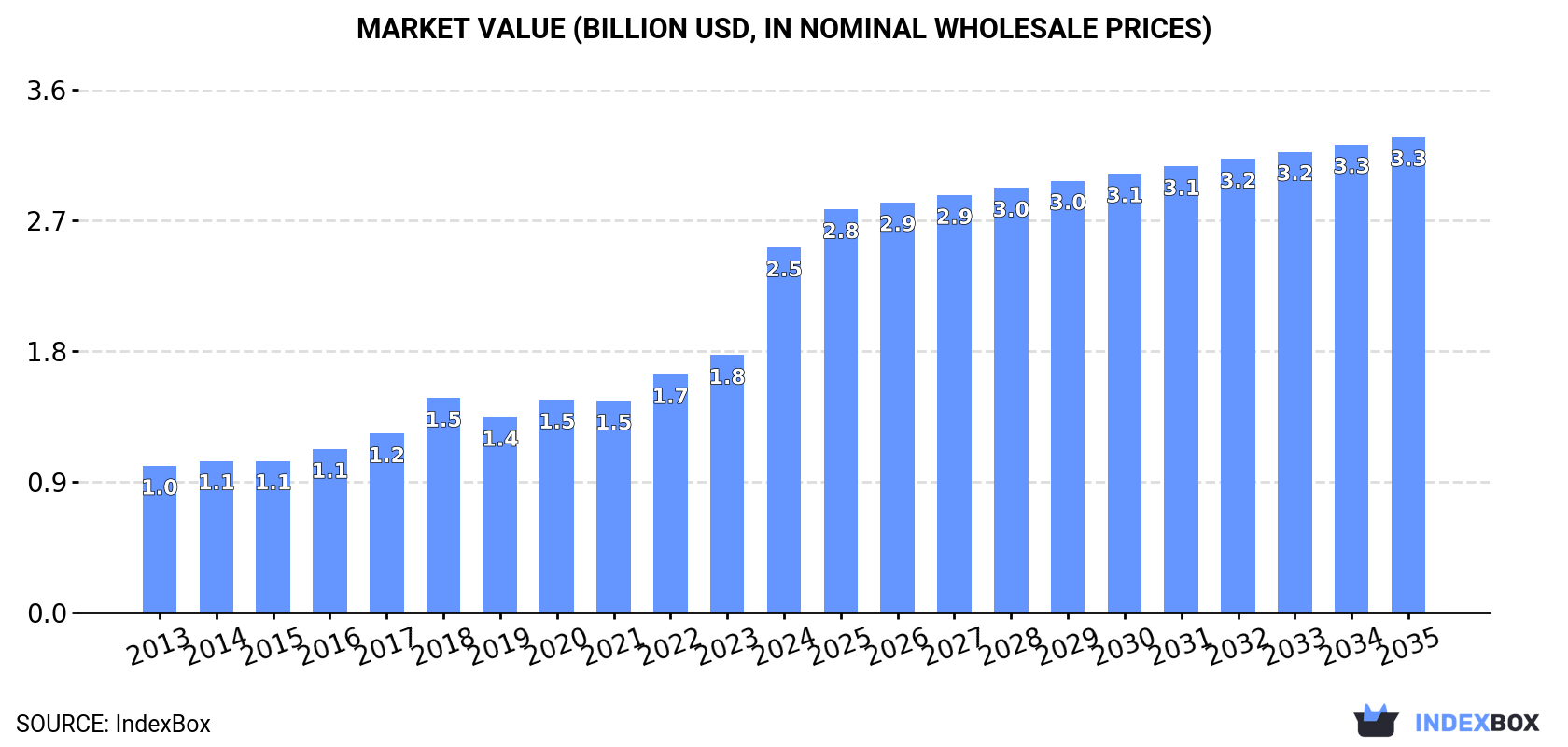

The demand for virgin olive oil in North America is on the rise, leading to an anticipated increase in market consumption. The market is expected to grow steadily over the next decade, with a projected CAGR of +0.9% in volume and +2.4% in value from 2024 to 2035. By the end of 2035, the market is forecasted to reach 359K tons in volume and $3.3B in value.

Market Forecast

Driven by increasing demand for virgin olive oil in Northern America, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +0.9% for the period from 2024 to 2035, which is projected to bring the market volume to 359K tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +2.4% for the period from 2024 to 2035, which is projected to bring the market value to $3.3B (in nominal wholesale prices) by the end of 2035.

ConsumptionNorthern America’s Consumption of Virgin Olive Oil

ConsumptionNorthern America’s Consumption of Virgin Olive Oil

In 2024, the amount of virgin olive oil consumed in Northern America rose markedly to 324K tons, increasing by 7.6% compared with 2023. The total consumption indicated notable growth from 2013 to 2024: its volume increased at an average annual rate of +3.5% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, consumption decreased by -10.2% against 2020 indices. Over the period under review, consumption hit record highs at 361K tons in 2020; however, from 2021 to 2024, consumption stood at a somewhat lower figure.

The value of the virgin olive oil market in Northern America surged to $2.5B in 2024, picking up by 42% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). In general, consumption recorded a resilient increase. As a result, consumption attained the peak level and is likely to continue growth in the immediate term.

Consumption By Country

The United States (283K tons) remains the largest virgin olive oil consuming country in Northern America, comprising approx. 87% of total volume. Moreover, virgin olive oil consumption in the United States exceeded the figures recorded by the second-largest consumer, Canada (41K tons), sevenfold.

From 2013 to 2024, the average annual rate of growth in terms of volume in the United States totaled +3.5%.

In value terms, the United States ($2.2B) led the market, alone. The second position in the ranking was taken by Canada ($314M).

In the United States, the virgin olive oil market increased at an average annual rate of +9.3% over the period from 2013-2024.

The countries with the highest levels of virgin olive oil per capita consumption in 2024 were Canada (1,043 kg per 1000 persons) and the United States (835 kg per 1000 persons).

From 2013 to 2024, the most notable rate of growth in terms of consumption, amongst the main consuming countries, was attained by the United States (with a CAGR of +2.8%).

ProductionNorthern America’s Production of Virgin Olive Oil

In 2024, approx. 16K tons of virgin olive oil were produced in Northern America; approximately mirroring the previous year. The total production indicated a perceptible increase from 2013 to 2024: its volume increased at an average annual rate of +4.4% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, production increased by +100.0% against 2014 indices. The pace of growth was the most pronounced in 2015 when the production volume increased by 75% against the previous year. The volume of production peaked in 2024 and is likely to see gradual growth in the near future.

In value terms, virgin olive oil production fell to $51M in 2024 estimated in export price. The total production indicated a modest increase from 2013 to 2024: its value increased at an average annual rate of +1.8% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, production decreased by -20.2% against 2021 indices. The growth pace was the most rapid in 2015 when the production volume increased by 68% against the previous year. The level of production peaked at $65M in 2017; however, from 2018 to 2024, production remained at a lower figure.

Production By Country

The United States (16K tons) constituted the country with the largest volume of virgin olive oil production, comprising approx. 100% of total volume.

From 2013 to 2024, the average annual growth rate of volume in the United States stood at +4.4%.

ImportsNorthern America’s Imports of Virgin Olive Oil

In 2024, imports of virgin olive oil in Northern America expanded significantly to 319K tons, increasing by 9.2% on the previous year’s figure. Total imports indicated a notable expansion from 2013 to 2024: its volume increased at an average annual rate of +3.5% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, imports decreased by -8.9% against 2020 indices. The most prominent rate of growth was recorded in 2018 with an increase of 22% against the previous year. The volume of import peaked at 350K tons in 2020; however, from 2021 to 2024, imports remained at a lower figure.

In value terms, virgin olive oil imports soared to $2.9B in 2024. Over the period under review, imports posted a buoyant increase. As a result, imports reached the peak and are likely to continue growth in the immediate term.

Imports By Country

The United States represented the largest importer of virgin olive oil in Northern America, with the volume of imports resulting at 278K tons, which was near 87% of total imports in 2024. It was distantly followed by Canada (41K tons), making up a 13% share of total imports.

The United States was also the fastest-growing in terms of the virgin olive oil imports, with a CAGR of +3.6% from 2013 to 2024. At the same time, Canada (+3.3%) displayed positive paces of growth. The shares of the largest importers remained relatively stable throughout the analyzed period.

In value terms, the United States ($2.5B) constitutes the largest market for imported virgin olive oil in Northern America, comprising 88% of total imports. The second position in the ranking was held by Canada ($360M), with a 12% share of total imports.

In the United States, virgin olive oil imports increased at an average annual rate of +11.1% over the period from 2013-2024.

Import Prices By Country

The import price in Northern America stood at $9,089 per ton in 2024, jumping by 44% against the previous year. In general, the import price posted a prominent increase. As a result, import price attained the peak level and is likely to continue growth in the immediate term.

Average prices varied noticeably amongst the major importing countries. In 2024, amid the top importers, the country with the highest price was the United States ($9,138 per ton), while Canada amounted to $8,759 per ton.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by the United States (+7.2%).

ExportsNorthern America’s Exports of Virgin Olive Oil

For the fifth consecutive year, Northern America recorded growth in shipments abroad of virgin olive oil, which increased by 62% to 11K tons in 2024. In general, exports enjoyed a buoyant expansion. As a result, the exports attained the peak and are likely to continue growth in the immediate term.

In value terms, virgin olive oil exports skyrocketed to $34M in 2024. Total exports indicated a temperate expansion from 2013 to 2024: its value increased at an average annual rate of +4.0% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, exports increased by +53.5% against 2021 indices. As a result, the exports attained the peak and are likely to continue growth in the immediate term.

Exports By Country

In 2024, the United States (10K tons) was the largest exporter of virgin olive oil in Northern America, mixing up 99% of total export.

The United States was also the fastest-growing in terms of the virgin olive oil exports, with a CAGR of +7.1% from 2013 to 2024. While the share of the United States (+3.9 p.p.) increased significantly, the shares of the other countries remained relatively stable throughout the analyzed period.

In value terms, the United States ($32M) also remains the largest virgin olive oil supplier in Northern America.

In the United States, virgin olive oil exports increased at an average annual rate of +4.1% over the period from 2013-2024.

Export Prices By Country

The export price in Northern America stood at $3,154 per ton in 2024, dropping by -4.2% against the previous year. Overall, the export price continues to indicate a perceptible decline. The pace of growth appeared the most rapid in 2021 an increase of 9.6%. Over the period under review, the export prices attained the maximum at $4,464 per ton in 2014; however, from 2015 to 2024, the export prices stood at a somewhat lower figure.

As there is only one major export destination, the average price level is determined by prices for the United States.

From 2013 to 2024, the rate of growth in terms of prices for the United States amounted to -2.7% per year.

Source: IndexBox Market Intelligence Platform

Dining and Cooking