The sudden buzz around Edenred (ENXTPA:EDEN) has been triggered by reports that French authorities are considering an 8% tax on lunch vouchers. This proposed change sent shockwaves through voucher providers, as Edenred’s share price dropped sharply, falling about 9% to levels not seen since early 2017. The regulatory spotlight has also raised broader questions about the future of public subsidies that many companies in this space depend on, making it a moment of heightened risk and uncertainty for investors weighing their next move.

This recent plunge caps off a year of headwinds for Edenred, whose stock has already declined more than 40% in the past twelve months. The company’s performance over the past three years reveals an even steeper slide. Coupled with mounting concerns about regulatory risks, investors are keeping a close watch to see whether this cascade could shift momentum further, especially after this pronounced selloff.

After such a dramatic move, there is ongoing debate over whether Edenred’s current price reflects all the risks or if it opens the door to a potential buying opportunity in the event that market fears have overshot.

Most Popular Narrative: 48% Undervalued

The dominant view suggests Edenred is trading well below its estimated fair value. Analysts project substantial upside if company targets are met.

“The broad global shift away from cash toward digital payments and voucher systems expands Edenred’s addressable market. Their investment in mobile-first and platform-based solutions (including integration with third-party apps like Metro Taipei) enhances product stickiness and cross-selling, leading to increased recurring revenues and higher operating margins.”

Curious what gives analysts the confidence to call such a wide gap between share price and fair value? The key factors are bold growth forecasts, margin enhancements, and an earnings multiple set well above the sector norm. Can Edenred live up to the high bar investors are quietly debating behind the scenes?

Result: Fair Value of €39.10 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, market saturation in mature regions and regulatory changes in Europe could present challenges to Edenred’s growth outlook and test investor optimism going forward.

Find out about the key risks to this Edenred narrative. Another View: Our DCF Model

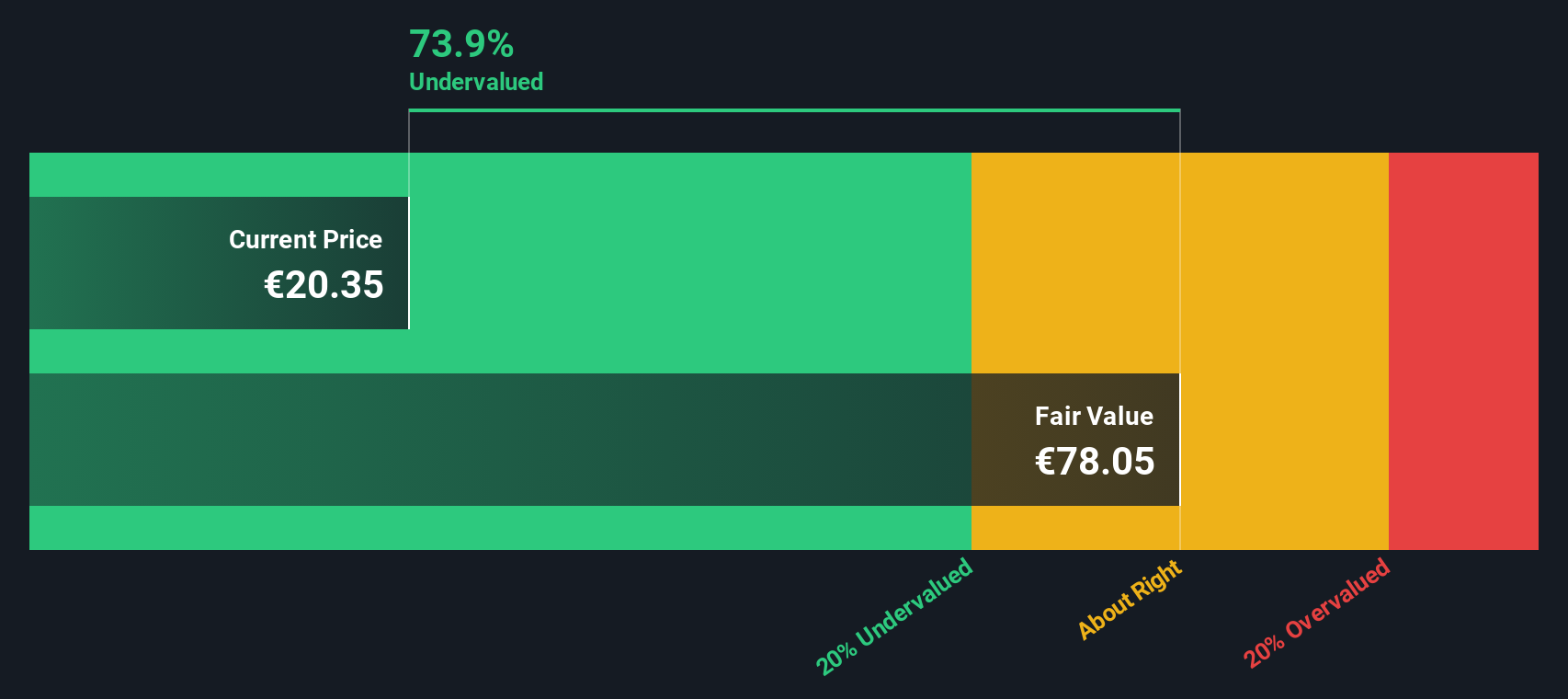

While the market often looks to earnings multiples for a quick value gauge, our SWS DCF model paints a similar picture and indicates the shares are still trading below their calculated fair value. Are both methods missing something, or is value truly hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.  EDEN Discounted Cash Flow as at Sep 2025 Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Edenred for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

EDEN Discounted Cash Flow as at Sep 2025 Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Edenred for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Edenred Narrative

If you see things differently or want to dig into the data on your own, it only takes a few minutes to create your own perspective. Do it your way.

A great starting point for your Edenred research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Fuel your portfolio’s growth by expanding your radar beyond Edenred. Don’t miss out on smart opportunities with some of the most promising trends shaping tomorrow’s markets.

Uncover overlooked gems with strong fundamentals and see which stocks stand out for their potential using the penny stocks with strong financials. Jump on the wave of artificial intelligence breakthroughs by tracking companies pushing the boundaries of smart technology with our AI penny stocks. Maximize value by tapping into opportunities where the market hasn’t caught up with the numbers by exploring our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Edenred might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Dining and Cooking