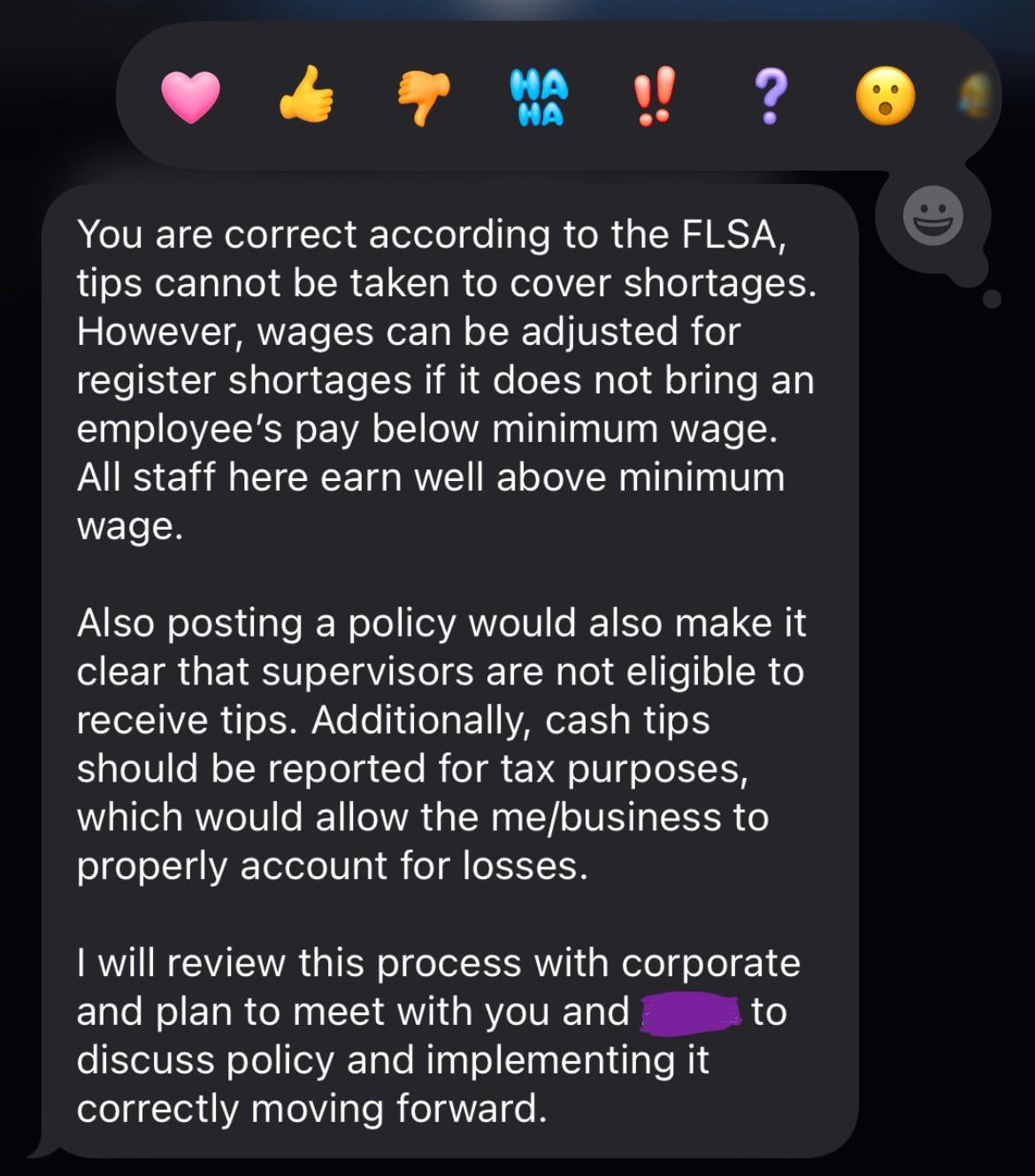

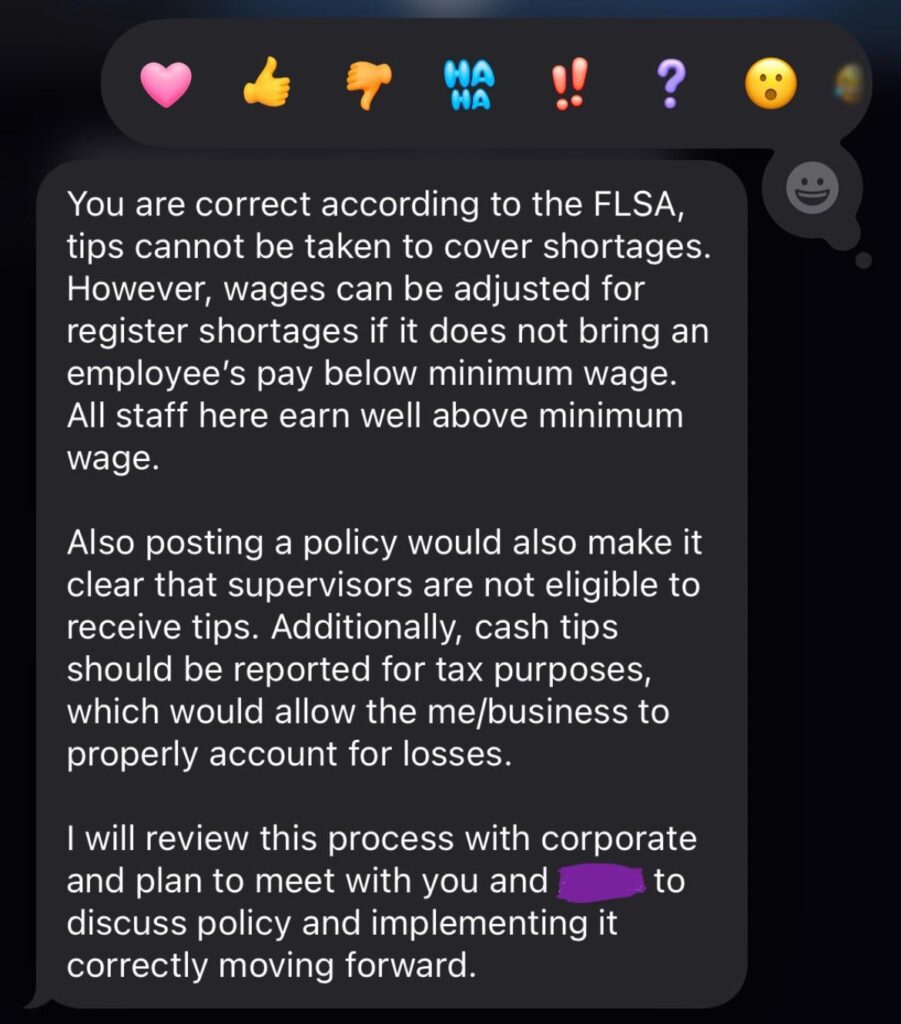

After doing some research, it appears something ELSE has been going on that isn’t legal: allowing us supervisors to participate in the pooled tips. I was told we all get to split it at the end of the night. According to the FLSA, supervisors cannot participate in pooled tips. I’ve been unknowingly breaking the law and taking tips from staff. I am aware that the credit card tips at the end of day are divided up between supervisor + employees that worked that day, per my boss. Some days it gets up to $70 so I do feel a bit bad. She does not have us report the cash tips for tax purposes so we enter a $0 at the end of day.

So she’s basically saying, because she illegally allows us supervisor to take home tips, that’s why it’s coming out of our tip money. WTF? I don’t know how to respond to this.

I polished my resume and applied to a couple places last night and will continue today 🤠

by loverlane

11 Comments

Shift supervisors can share in pooled tips if they’re doing customer service and everyone is paid above minimum wage and the tip pool guidelines are clear and consistent.

That’s not the same thing as someone in management – hiring, firing, setting salaries.

I still don’t really understand this policy though. Registers should be inconsistent, if they are not someone is most likely stealing from them and forging what’s in the drawers. If the register was short 10-100 dollars I would be suspicious but a quarter is literally nothing to worry about. I don’t know why you would create stress and turmoil over a quarter.

Take your sweet time getting change for people, counting twice, etc. Every time a customer gives a look or mentions something about it, just sheepishly say “sorry, the owners require that employees have to pay for all register shortages down to the penny, I just need to make sure this is correct.”

Also, good on you for applying elsewhere. That place sounds toxic.

If you’re a manager, you’re not eligible for tips. The reason for this is so that managers dont put themselves into a position to get more tips via things like scheduling or task assignments.

There are situations where they’re eligible, however, it’s best policy to simply not allow managers to partake in tip share altogether so there’s more ambiguity.

I believe in most states (but not covered by FLSA), they can’t make deductions to cover register shortages unless you’ve agreed to it in writing before the deduction is made. There may have been a form in your onboarding paperwork agreeing to those deductions, especially if you went through a big packet of stuff, but otherwise you should check your state’s law about pay deductions.

Nope. The employer is wrong.

Call 1-866-4-USWAGE (1-866-487-9243) to file a complaint with the department of labors wage and pay division.

Damn, so she was allowing you to receive tips and you fucked it up… nice job buddy

with regard to taking wages for breakage:

If the employee is a server and the restaurant is taking the tip credit, their base wage + tip credit must be at least minimum wage. Tips actually received do not count, as tips are a transaction between the customer and the server and the restaurant has no claim on them. So if taking any amount out would reduce the servers wage + tip credit to below minimum, then it can’t be taken out.

As most servers are paid minimum wage + tips, there is usually no or very little wages above minimum that can be taken.

WAGE THEFT

Why are variances coming out of wages or even tips? That seems petty. You fire people that can’t count.

When you start doing shit like that, you’re more likely to get employees to short change customers to force balance. What happens if you’re over? Keep the money as a tip?

The best thing to do is track overage and shortages per employee. Keep them separate so they don’t cancel each other out. Then, when an employee hits a set limit for shortage or overage, you fire them.

If someone is short/over a quarter, then the company should just eat it. Have a threshold for when it starts counting as a write-up and gets added to the total. Too many write ups or limits reached then termination.

A manager is defined by the FLSA as someone who meets ALL of the following 3 criteria:

[the employee customarily and regularly directs the work of at least two or more other full-time employees or their equivalent;](https://www.dol.gov/agencies/whd/fact-sheets/15b-managers-supervisors-tips-flsa)

the employee has the authority to hire or fire other employees, and/or their suggestions and recommendations as to the hiring, firing, advancement, promotion or any other change of status of other employees are given particular weight;

and

the employee has a primary duty of managing the enterprise or a customarily recognized department or subdivision of the enterprise.

If they don’t meet all 3 of those they can be in a tip pool.