In yesterday’s thread on French supermarket wine, a number of redditors were amazed by how the Europeans can make decent cheap wine, but American, Canadian, and most new world producers cannot. Now to be fair, a lot of really cheap European bottom shelf wine is crap too, but it is obvious that European producers can turn out cheaper wine than new world producers can.

If you look at any European supermarket, you can see tons of wines for less than 2 Euros. In Southern Europe, you can even find wine at less than 1 Euro. Even if you ignore the fact that European consumers sometimes pay less in sales and sin taxes on wine, it is incredible that European producers can come how produce wine far, far cheaper than new world producers typically can.

Why is that? Well, I want to quickly discuss the economics of new world vs old world wines, and why European producers can churn out really cheap wine.

For the purposes of this discussion, I would focus mostly on US and Canadian producers, although the vast majority of these factors also impact other new world production regions like Australia, New Zealand, etc.

​

**New world producers pay excise tax:**

Excise tax refers to the tax levied on producers at the time of production – A cost that will inevitably be passed on to the consumer. Excise taxes are levied at the Federal level, the provincial/state level, and sometimes the local level.

In Canada, the federal excise tax is 50 Canadian cents for a 750ml bottle. In America, the federal excise tax is between $1.07 – $3.40 (USD) per gallon – So between 26 cents and 68 cents per standard 750ml bottle. There is usually a further state level excise tax and occasional local excise taxes – In Oregon there is an excise tax of $0.67-0.77/gallon, in Ontario there is a volume tax of 29 Canadian cents a liter.

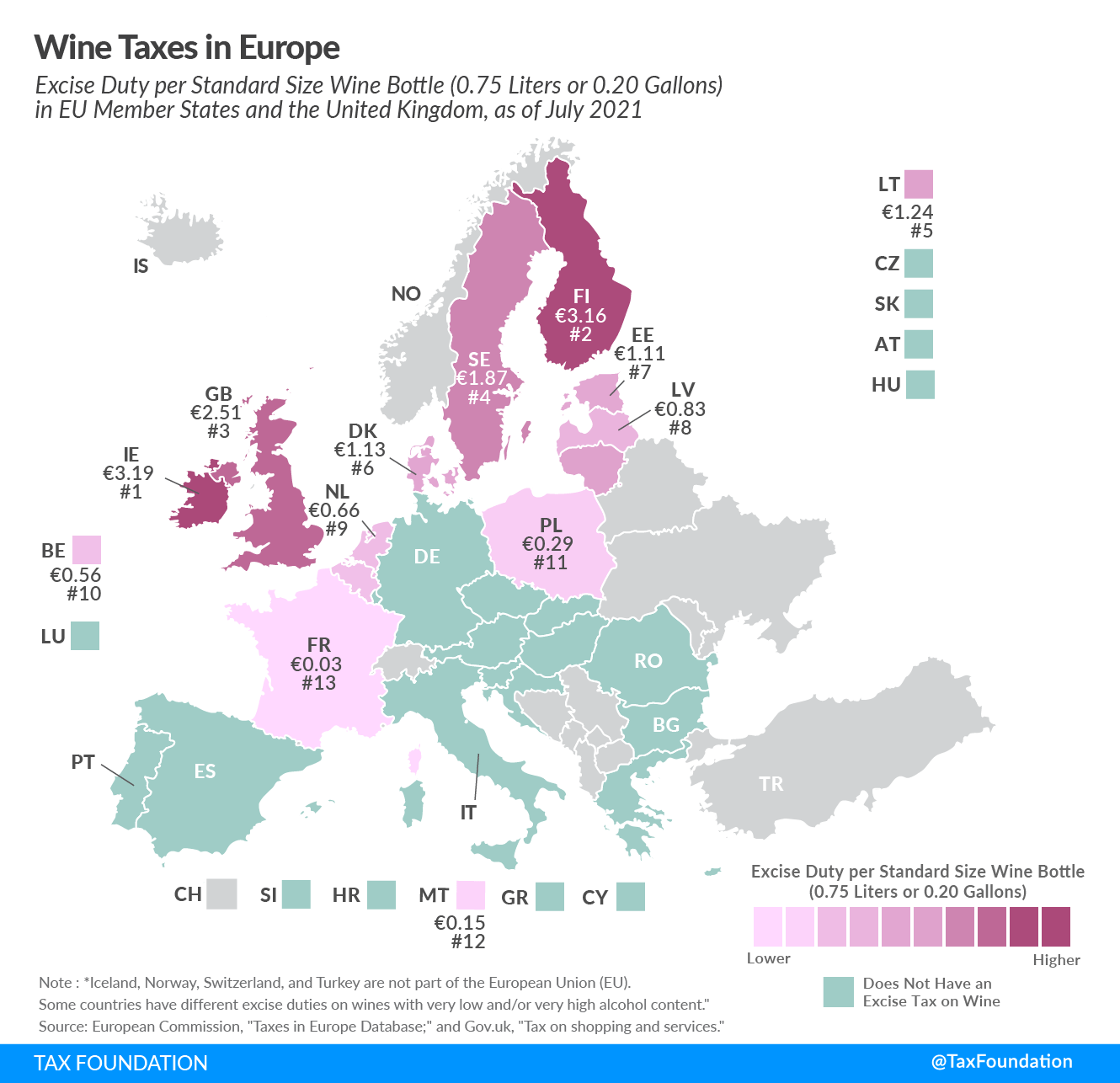

In Europe? the [big producing regions have no excise tax](https://files.taxfoundation.org/20210818173726/2021-wine-taxes-in-Europe.-Compare-excise-duty-on-wine-including-germany-wine-tax-spain-wine-tax-and-france-wine-tax.png) \- Spain, Portugal, Italy, Greece, and Germany have no excise tax. France has a 3 cent per bottle excise tax.

​

**Not only do old world producers not pay excise tax, they receive subsidies**

Not only do old world producers not pay excise tax, many European countries subsidize wine production – A lot of bottom shelf wines cannot be profitably made without taxpayer subsidies.

In Europe, the wine sector is heavily subsidized – Both production, capital investment, and promotion. [Between 2014 and 2018, €6024 million was spent on wine subsidies](https://www.eurocare.org/media/GENERAL/docs/reports/europesbillioneurowinespillage.pdf) at the EU/Federal level with the CAP.

In many European wine producing countries, there are also subsidies in vineyard capital investment and human capital investment. For instance, in France vine replanting gets a government subsidy, and young vintners getting into the industry receives various forms of government support.

Finally, sometimes wine production is simply not profitable due to external events – When this happens, European governments routinely enact price supports and supply destruction. For instance, support wine makers and shield them from the impacts of Covid=19, the French government announced that they will bulk purchase 250 million bottles of wine to distill into hand sanitizer and industrial alcohol.

​

**Most new world producers are still trying to pay off land costs**

Vineyards are very expensive. At the absolute bottom level, agricultural land suitable for grape production costs $10,000 an acre, better production regions cost $100-200 thousand an acre, while prime real estate can cost up to $1 million an acre.

Vineyards yield 1000- 7000 750ml bottles an acre per year. If you assume an average of 3000 bottles an acre, and your vineyard costs were $100 thousand an acre. If you put down 20% down payment, and get an agricultural mortgage at 6% for 30 years, yearly mortgage payments on that acre of vineyard is $9144. At 3000 bottles yield, you are looking at $3.04 per bottle on land costs alone.

Most new world production regions are relatively new. For example, in 1970 there were only 5 commercial wineries in Oregon, today there are 1056 of them. Most new world wineries were established in the last 30 years, and thus, they still have to pay off the mortgage on their land.

Old world producers? For most of them the owners have owned the land for years, generations, they paid off land costs years if not centuries ago.

​

**What does this mean? Unless you are a premium winery charging higher prices, or a huge industrial scale winery producing massive volumes, new world wineries are pretty much tourist attractions and event venues**

Scilion Valley Bank provides business loans to a lot of wineries, so [they produce a report on the state of the American wine industry](https://www.svb.com/globalassets/trendsandinsights/reports/wine/svb-state-of-the-wine-industry-report-2023.pdf). On page 65 of the report, there is a very interesting breakdown of the wine industry’s sales channel mix for the average winery.

[Extracted from the report here](https://imgur.com/Ff5QVAd).

Wholesale off premise refers to liquor stores and grocery stores that sell wine for consumption “off premise”, and wholesale on premise refers to bars, clubs, restaurants who sell wine for consumption “on premise”.

For the average American winery in 2022, 3 times more wine was sold out of their tasting room than out of liquor stores and grocery stores. This means that their business is not built off selling wine wholesale to retailers for people to buy and drink at home.

Instead, these wineries survive by attracting visitors – Visit their winery, eat at their restaurant, tour the fields, and in the end, stop by the tasting room and buy a bottle. Perhaps if you like it, you can join their wine club and get a few bottles delivered to you every month.

by Uptons_BJs

15 Comments

PS: I want to follow up with some discussion specific to Ontario, but probably applies to most of Canada.

​

When you go to the LCBO and pay $10 for a bottom shelf bottle of wine, [the winery takes home 27% of that,](https://www.thelushlife.ca/the-cost-of-ontario-wine/) or $2.70. You ever wonder why bottom shelf Canadian wine is practically all mega wineries fermenting wholesale grapes with industrial processes? There’s no way you can keep the lights on with a small winery growing your own grapes with that kind of tax and fee structure.

​

In Europe I’ve had the chance to drink unique, interesting wines from small wineries who make wine with their own grapes for 3 euros a bottle. Now to be honest, most of those bottles aren’t very good (hence why they’re 3 euros only), but they are made from locally produced grapes with an expression of terroir.

​

In Canada, if the winery only takes home $2.70 from a $10 bottle while needing to pay for land, it is inevitable that the only wineries who can profitably make a bottle of wine at $2.70 are mega wineries growing super high yield grapes, blended together and fermented in bulk.

Interesting input. It might also be worth mentioning that some European countries (e.g France) have laws capping the ground rent an investor can expect from a vineyard lease, which also keeps the land cost low.

Land costs are the real reason. $.26 excise tax isn’t moving the needle

New Zealand and S. Africa do fine with cheap wine.

It was about five years ago that the avg price of a U.S. wine rose above $10.

There is definitely a difference in costs if you are buying grapes vs. have a vineyard that you’ve owned long enough to pay off.

Interesting data! If the main difference is land costs, and the majority of that land cost is from a mortgage (not property taxes), does that mean that we should expect wine costs for American/New World wines to drop off in the next 30 years once more wineries are able to pay them off?

In the US, the three-tier system also contributes some extra costs to the consumer.

yellowtail is a cheap and good “new world” wine

Why does the wine producer only get 27% of the price of a bottle? Where does the other 73% go? For example, you have nicely explained how 50 cents goes to excise tax, and $3 for mortgage. Since most “cheap” US and Canadian wine is $10-20 a bottle (in the Okanagan more like $20-30), there is still a huge delta that is unexplained between $3.50 (taxes and mortgage) vs $23.50 (price I pay).

Base cost is high but you also have to account for the fact that there are a lot of Americans and we only produce so much wine, especially quality wine. We’re probably 1/20th of production per Capita compared to the old world countries on a relative basis. The cost difference is nominal at the bottle level.

Great write up! Would award if I had any.

Did you ever think, that maybe it exists, but the retailer/store won’t carry it? Also, why do you want to drink plonk?

Uruguay makes some very good cheap wines.

It’s land cost AND cost of labor.

Overhead in most English predominant new world countries (US, Canada, New Zealand, Australia) includes land cost and paying people to do the work out in the fields and the wineries.

In those countries they typically employee a labor force at or above the minimum wage for the season, they have a dedicated oenologist and/or winemaker, they have a full cellar crew in the off season, and they pay to have a marketing coordinator.

In Europe they take advantage of students/recent graduates to do unpaid/lowly paid internships in exchange for a place to stay and food. They use a migrant/local workforce that they pay under the table for or again for food on the table and a place to stay, and by in large, they’ve owned the land for generations so there’s no investors or banks to pay back interest to.

I don’t want this to come off as anti-European. But the fact is, by in large, the wine producing population (people getting dirty) in a lot of vineyards/wineries in Europe are getting screwed.

That said, there are good experiences to be had, and you need to cut your teeth somewhere, and if I could work in Bordeaux or Burgundy or Piedmont, and I could afford it I would. But I would much rather make $20/hour or $25/hour in Cali or Australia/New Zealand, then walk away with a pat on the back and a hand shake in Italy or France.

You omitted VAT. In Italy it’s 22%, in France it’s 20% – it’s much higher than average 6% or so sales tax in USA.

In Germany direct sales are the major source of income for most smaller wineries.